The Corporate Transparency Act (CTA) marks a significant shift in corporate reporting, mandating certain entities to disclose ownership structures to the federal government. We examine who qualifies as a reporting company, covering aspects like size, industry segments, and ownership constructs.

by LawInc Staff

January 9, 2024

A new era of corporate transparency emerged on January 1, 2024. The Corporate Transparency Act (CTA) established sweeping regulations requiring certain entities disclose current ownership structures to the federal government.

Navigating nuanced reporting obligations for your company tied to this seismic policy shift promises challenges. But non-compliance risks significant penalties.

Here, we assess the CTA’s central question: Who qualifies as a reporting company?

We walk through exactly how the law’s complex definitional boundaries determine coverage, accounting for size, industry segments and ownership constructs.

Avoid missteps mired in ambiguities. Dive into precise explanations of the reporting company designation complete with checklists to accurately assess your obligations.

Master corporate transparency filing requirements with confidence. Here’s everything to know regarding the Act’s reach woven with insights from FinCEN’s latest guidance and FAQs.

What is a Reporting Company?

Exploring Reporting Company Types in the CTA

Two categories qualify entities as reporting companies subject to beneficial ownership disclosure:

-

- Domestic Reporting Companies: Corporations, LLCs or any entities created by filing documents with a U.S. state/tribal Secretary of State.

- Foreign Reporting Companies: Entities formed under foreign laws registered to do business in the U.S. via domestic filings.

Examples:

-

- LLCs filing Articles/Certificates of Organization

- Corporations submitting Articles/Certificates of Incorporation

- Canadian firms registering through Secretaries of State

- Cayman Islands entities registered to transact business in a specific state

How to Proceed:

-

- Submit initial report to FinCEN

- Collect beneficial ownership information

- Update details within 30 days of changes

- Face penalties for non-compliance

- Respond to authorized information requests

FAQs:

-

- What if I qualify for an exemption? Consult specific exemption guidance documents or legal counsel to confirm your exempt status.

- Can I report P.O. box instead of street address? No, an actual U.S. street address is required on BOI reports to FinCEN.

- What are acceptable forms of ID to provide? Non-expired U.S. passports, driver’s licenses, or state/tribal ID documents containing unique identifying numbers.

- Do beneficial owners have reporting obligations too? Not directly, but they must provide companies accurate ownership details needing disclosure.

- Can foreign entities register anonymously? No, identifying documentation must substantiate registration paperwork to fulfill transparency mandates.

Next, we examine the many exemption possibilities circumscribing this designation’s wide reach.

Exemptions from Reporting Company Definition

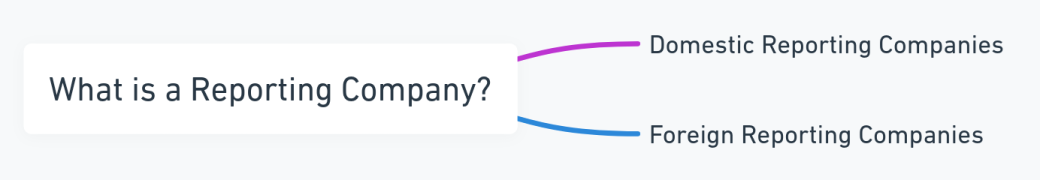

Key Exemptions from CTA Reporting Requirements

While the reporting company designation covers a wide range of entities, Congress built in 23 exemptions targeting specific industries or entity types:

-

- Public Companies: Those with securities registered on national exchanges meeting SEC reporting requirements.

- Financial Institutions: Banks, credit unions, money transmitters, investment advisers etc. regulated by existing AML rules.

- Non-Profits: 501(c) charities, political organizations, trusts assisting exempted entities.

- Certain Large Companies: Those with over 20 full-time U.S. employees AND over $5 million in gross receipts filing U.S. tax returns.

- Dormant Entities: Qualifying inactive companies with ownership, asset and revenue restrictions.

Examples:

-

- Publicly traded shares on NASDAQ

- State chartered community banks

- Payroll/staffing companies meeting size thresholds

- Large credit union chains with vetted controls

- Money transmitters licensed by regulators

Qualifying Process:

-

- Review full legislative exemption language

- Collect substantiating evidence

- Consult legal counsel if uncertain

- Document status in corporate records

- Indicate exemption on BOI forms

FAQs:

-

- What if my entity status changes? Promptly review reporting obligations again if previously exempt.

- Do subsidiaries of exempted companies qualify? Yes, if wholly owned by exempted entities.

- Is the $5M gross receipts threshold net or gross? It is gross receipts or sales, not adjusted for returns or allowances.

- Are non-profits automatically exempt? Those meeting 501(c) IRS code criteria still file BOI reports.

- Can “inactive” companies avoid reporting? If meeting strict dormancy, ownership and asset test criteria.

Next we detail approaches for identifying your company’s beneficial owners.

Identifying Beneficial Owners

Criteria for Identifying Beneficial Owners

Companies must identify individuals:

-

- Owning 25%+ Ownership Interests: Equity shares, capital/profit stakes conferring controlling rights.

- Exerting Substantial Control: Senior executives, governing body appointment authorities, key decision makers.

- Through Direct or Indirect Means: Via intermediaries, layered entity structures, contractual arrangements.

- No Limit on Number: All qualifying individuals get reported regardless of total percentage controlled.

- Exceptions Apply: Minors, nominees, employees, future inheritors and creditors retain exemption.

Examples:

-

- CEOs, CFOs, General Counsels

- Board Members/Committee Chairs

- LPs/LLC Members Controlling Stakes

- Multiple Children Sharing Future Inheritances

- Overseas Parents Owning Conglomerates

Checklists Available:

-

- Substantial Control Indicators

- Ownership Interest Classifications

- Exception Qualification Criteria

- Sample Calculations

- Data Collection Templates

FAQs:

-

- What if ownership records contradict? Courts determine most credible claims based on totality of evidence.

- Do LLC tax classification elections impact designations? No, beneficial disclosures operate independently from tax filings.

- What about complex equity vesting agreements? Report fully vested holdings plus future vesting interest rights.

- Are non-U.S. persons living abroad included? Yes all direct/indirect qualifying foreign owners get reported.

- What if identifying details like SSNs aren’t available? Alternate foreign/local substitutes still qualify.

Next we detail reporting requirements concerning company applicant information.

Company Applicant Information

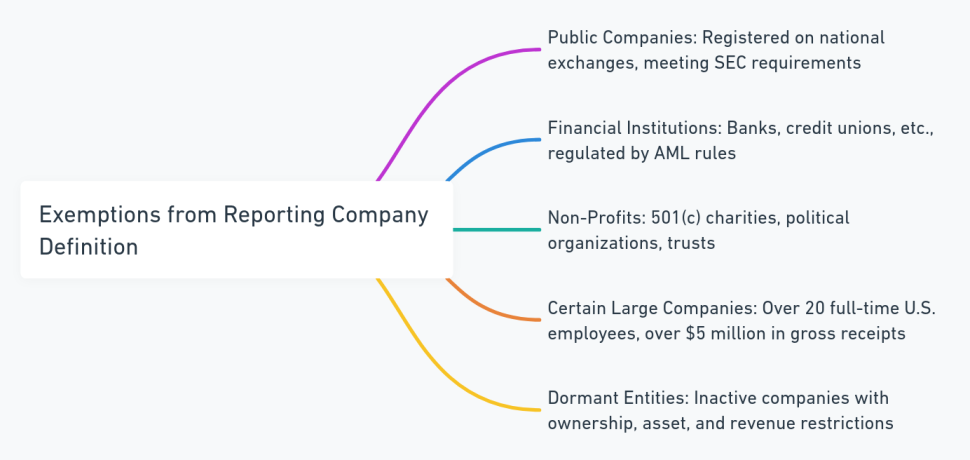

Understanding Company Applicant Information Requirements

Only companies created or registered on/after 01/01/2024 must provide applicant details:

-

- Direct Filers: Those submitting initial formation/registration paperwork.

- Control Filers: Individuals directing/managing filing process.

- Up to 2 Reported: Single applicant entities name one; joint efforts name two.

- No Updates Needed: Changes in company applicant status don’t require amended submissions.

Examples:

-

- Attorneys drafting/filing formation documents

- CPA firm partners directing registration checklists

- Corporate services steering STATE/IRS submissions

- Other third-party filers like paralegals

- Internal staffers submitting via portals

Required Information:

-

- Full legal name

- Residential address

- Date of birth

- Photocopy ID (drivers license/passport)

- If a nominee, the actual person represented

FAQs:

-

- What if applicants are foreign citizens? Alien registration numbers qualify for ID substantiation.

- Do company owners also list selves separately as applicants? No duplicate reporting required unless distinct roles.

- Can applicant details stay confidential? No public access but government/bank authorization protocols apply.

- What are possible penalties for false applicant submissions? Civil fines and criminal fraud charges mirroring treatment of beneficial owners.

- What if an applicant is replaced or added later? No amendatory filings needed regardless of personnel changes post-inception.

Next we summarize overall information required in initial and updated FinCEN disclosures.

Required Report Contents

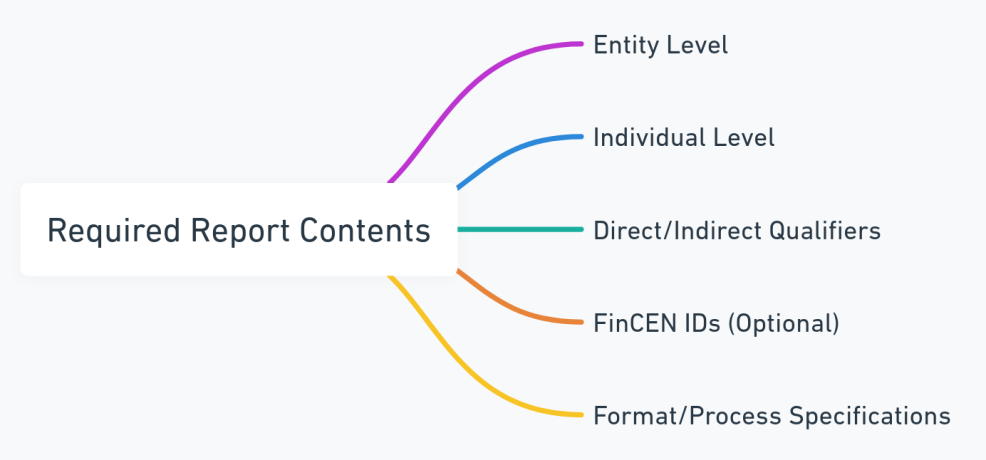

Overview of Required Report Contents for CTA Compliance

Reports to FinCEN encompass data across two dimensions:

-

- Entity Level: LEI, addresses, jurisdictions, tax IDs establishing corporate existence.

- Individual Level: Beneficial owners plus, if applicable, company applicant granular attributes like full legal names, birthdates and photocopy ID documentation.

- Direct/Indirect Qualifiers: Specify whether substantial control or ownership interests are exercised directly or through intermediaries.

- FinCEN IDs (Optional): Unique identifying numbers individuals/companies can obtain from FinCEN for inclusion instead of underlying personal details.

- Format/Process Specifications: SECURE Disclosure format/protocols for compiling/submitting reports published separately.

Examples:

-

- IRS EIN numbers

- Individual middle names

- Addresses including apartment numbers

- Citizenship declarations

- Driver’s license images

Amendment Protocols:

-

- Update within 30 calendar days of entity/beneficial owner data changes

- No modifications needed for company applicant status shifts

- Correct erroneous submissions within 30 calendar days of recognition

- Special exemptions introduced for companies dormant for decades

- Immaterial changes may accumulate minimally before triggering threshold

FAQs:

-

- Can supplemental statements be appended elaborating on submissions? Yes, with certain restrictions and redaction requirements detailed separately.

- What happens if a court or state company registry changes an entity name without affirmative owner action? Updates would still be required within 30 days of occurrence.

- Do all entities reporting need registered agents able to accept FinCEN service of process? No, though remaining responsive to information requests remains imperative.

- Can third parties like law/accounting firms compile/file reports on behalf of clients? Yes, pursuant to appropriate engagement authority with executing signoff by an empowered representative of the reporting company itself.

- What are possible penalties for missing deadlines or submitting inaccurate reports? Willful non-compliance risks stiff criminal/civil fines and imprisonment with liability extending across corporate leadership.

Next we discuss compliance expectations, enforcement and liability considerations.

Compliance Considerations

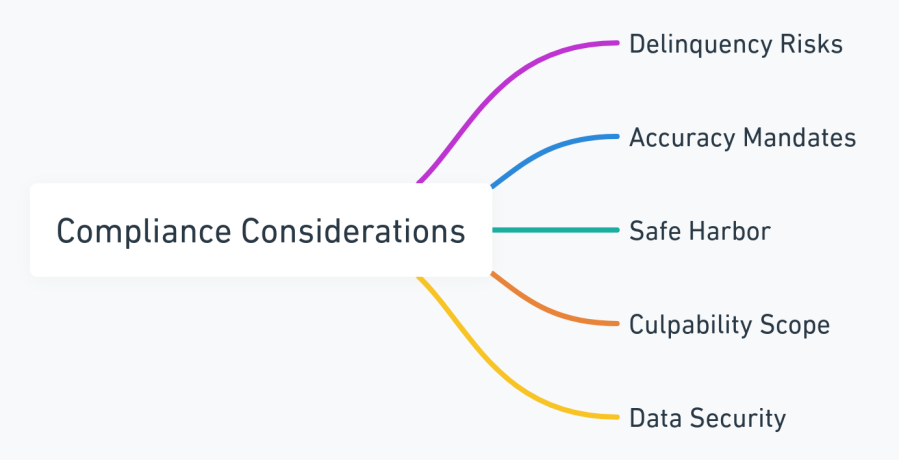

Understanding Compliance Aspects of the CTA

Stringent regulations carry heightened enforcement expectations:

-

- Delinquency Risks: Failure to report within mandated timeframes risks penalties from $500 daily, up to $10,000.

- Accuracy Mandates: Incorrect or incomplete disclosures must be amended within 30 calendar days of identification.

- Safe Harbor: Volunteer corrections within 90 calendar days avoid fines.

- Culpability Scope: All leadership, compliance personnel and external filing representatives share duty of care.

- Data Security: Federal-grade information safety controls prevent external leakage though authorized access protocols govern.

Examples:

-

- CEOs accountable despite delegating filing obligations

- Procrastinating initial submissions despite awareness

- Undisclosed dividend issuances conferring unexpected ownership shifts

- Inadvertent trade name changes escaping 30 day update clock

- Reliance on faulty beneficial owner assessments

Best Practices:

-

- Assign dedicated internal ownership governance teams

- Incorporate compliance checklists into operating rhythms

- Overcommunicate with external counsel

- Explore supplemental cybersecurity protections

- Maintain orderly archived records easily referenced

FAQs:

-

- What are possible criminal penalties beyond civil fines? Up to 2 years imprisonment for willful non-compliance across dimensions ranging from reporting to accuracy.

- What happens if beneficial owners refuse to disclose identities thinking hiding is better? Severe charges still apply absent voluntary disclosure, and courts can compel identification.

Need Beneficial Ownership Reporting Help?

If you require guidance on corporate transparency responsibilities, contact us to get connected with a legal advisor that can provide tailored counsel navigating requirements.

Test Your Corporate Transparency Act Knowledge

Questions: What is a Reporting Company?

-

- 1. Which entities qualify as domestic reporting companies?

- A) Sole proprietorships

- B) General partnerships

- C) C-Corporations

- D) Limited liability companies

- 2. What defines foreign reporting companies?

- A) Entities following state business laws

- B) Companies with overseas registrations

- C) Organizations with non-US headquarters

- D) Those registered in a state to operate

- 3. Which status would exempt reporting?

- A) Being a small business

- B) Having minority foreign investors

- C) Qualifying as a public company

- D) Being a non-profit organization

- 4. Can LLCs use P.O. box addresses in reports?

- A) Yes

- B) In certain cases

- C) Only if owners approve

- D) No

- 5. What risks non-compliance with transparency rules?

- A) Tax penalties

- B) Licensing suspensions

- C) Disclosure fines

- D) Reputation damage

- 1. Which entities qualify as domestic reporting companies?

Answers:

-

- 1. C, D – C-corporations and LLCs created by filing documents with state/tribal authorities qualify as domestic reporting companies.

- 2. D – The key qualifier for foreign reporting companies involves registering to operate inside the US under state laws.

- 3. C – Meeting SEC public company reporting rules provides exemption from broader transparency mandates.

- 4. D – P.O. boxes cannot substitute for actual US street addresses when submitting reports.

- 5. C – Civil and criminal fines apply directly for delinquent, inaccurate or incomplete ownership disclosures.

Questions: Exemptions from Reporting Company Definition

-

- 1. Which status would not provide reporting exemption?

- A) LLC structure

- B) Bank regulator oversight

- C) Public company filings

- D) Political organization

- 2. What disqualifies claiming dormant entity exemption?

- A) High revenues

- B) Assets over $5,000

- C) Too much ownership turnover

- D) Ongoing business activity

- 3. Can subsidiaries of exempted entities avoid reporting?

- A) If privately held

- B) Depending on location

- C) In certain circumstances

- D) If wholly owned

- 4. Does the $5M gross receipts threshold for exemption refer to gross or net sales?

- A) Net amount

- B) Gross amount

- C) Bottom line net income

- D) EBITDA

- 5. If exempt status changes, what procedure applies?

- A) File new incorporation

- B) Update registrations

- C) Voluntary disclosure

- D) Review reporting obligations

- 1. Which status would not provide reporting exemption?

Answers:

-

- 1. A – LLC designation itself does not provide blanket exemption – formal filings determine coverage.

- 2. D – Continued business operations disqualify claims of dormancy to avoid reporting requirements.

- 3. D – Wholly owned subsidiaries of specifically exempted parent companies also skip reporting.

- 4. B Gross receipts refers to total top-line sales without subtracting returns/allowances.

- 5. D Promptly reconfirm reporting obligations upon status shifts potentially changing applicability.

Questions: Identifying Beneficial Owners

-

- 1. What is the ownership threshold conferring substantial control?

- A) 10% equity

- B) 15% equity

- C) 20% equity

- D) 25% equity

- 2. Which role would avoid designation as beneficial owner?

- A) Corporate executive

- B) Board director

- C) Future inheritor

- D) LLC manager

- 3. What requires reporting regardless of total percentages controlled?

- A) Direct owners meeting thresholds

- B) Registered agents

- C) Creditors

- D) All qualifying individuals

- 4. Can non-US persons be designated as beneficial owners?

- A) If holding green cards

- B) In certain cases

- C) If residing in the US

- D) Yes

- 5. What happens if submitted ownership records conflict?

- A) IRS investigation

- B) External audits

- C) Court determination

- D) Voluntary correction

- 1. What is the ownership threshold conferring substantial control?

Answers:

-

- 1. D – The 25% equity threshold establishes requisite substantial control over businesses.

- 2. C – Future inheritors represent an exception excluded from current beneficial owner designations.

- 3. D – Regardless of total percentages controlled, all individuals meeting definitions get reported.

- 4. D Yes, qualifying foreign persons still require reporting regardless of immigration status.

- 5. C Courts ultimately determine most credible claims and evidence chains when ownership records conflict.

Questions: Company Applicant Information

-

- 1. What defines control filers regarding applicant reporting?

- A) Individuals owning companies

- B) Those directing registration process

- C) Persons submitting documents

- D) Agents of service

- 2. Up to how many applicants can a company name?

- A) 1

- B) 2

- C) 3

- D) 4

- 3. Do applicant changes require report updates?

- A) Yes

- B) No

- C) In certain cases

- D) Only major changes

- 4. What information confirms applicant identity?

- A) Tax returns

- B) Legal contracts

- C) Photo ID

- D) Birth certificates

- 5. Can applicant details remain confidential from public view?

- A) Yes

- B) No

- C) For private companies

- D) With owner approval

- 1. What defines control filers regarding applicant reporting?

Answers:

-

- 1. B Control filers refer to those directing or managing the registration filing process.

- 2. B Companies can name up to 2 applicants – one entity or two individuals.

- 3. B Unlike beneficial owners, applicant changes do not necessitate report amendments.

- 4. C Driver’s licenses or passports help substantiate applicant identities.

- 5. B While access protocols apply, applicant details cannot be kept fully confidential.

Questions: Required Report Contents

-

- 1. What report data covers entity-level details?

- A) Owner identities

- B) Tax numbers

- C) Addresses

- D) Legal jurisdictions

- 2. What indicates whether control is direct or indirect?

- A) Percentage stakes

- B) Title roles

- C) Ownership layers

- D) Qualifiers noting means

- 3. In lieu of personal details, what can individuals include?

- A) Alias names

- B) Tax identifiers

- C) FinCEN ID numbers

- D) Third party references

- 4. How treat immaterial report changes before updates needed?

- A) Report immediately

- B) Note internally only

- C) Seek legal counsel

- D) Allow to accumulate

- 5. What protocols detail compiling and submitting reports to FinCEN?

- A) Ownership classification guides

- B) IRS documentation standards

- C) SEC filings procedures

- D) Separately published process specifications

- 1. What report data covers entity-level details?

Answers:

-

- 1. D Legal jurisdictions, addresses and entity IDs comprise entity-level report data.

- 2. D Direct vs indirect control qualifiers outline if ownership means are intermediary based.

- 3. C In lieu of private details, FinCEN ID numbers can optionally get included.

- 4. D Immaterial changes may accumulate minimally before triggering update thresholds.

- 5. D SECURE Disclosure formatting and protocols publish separately from core regulations.

Questions: Compliance Considerations

-

- 1. What risks apply for report omissions or delays?

- A) Tax liens

- B) Documents seizures

- C) $500 daily fines

- D) Facility closures

- 2. What provides compliance violation safe harbor?

- A) Legal opinions

- B) Voluntary corrections

- C) Materiality exemptions

- D) Third party reliance

- 3. Who shares in compliance enforcement liability?

- A) Investors

- B) Employees

- C) Leadership and gatekeepers

- D) Creditors

- 4. How will data access protocols balance confidentiality?

- A) Restricting searchability

- B) Anonymizing personal details

- C) Limiting third-party disclosures

- D) Federal-grade security controls

- 5. What enforcement risks pattern neglect?

- A) Tax liens

- B) License suspensions

- C) Site closures

- D) Charter revocations

- 1. What risks apply for report omissions or delays?

Answers:

-

- 1. C Delinquent or omitted reporting risks $500 daily fines as penalty.

- 2. B Voluntarily correcting inaccurate submissions within specified periods avoids fines.

- 3. C Liability for non-compliance extends across corporate leadership and gatekeepers like attorneys/accountants.

- 4. D Stringent federal-grade security controls enable accessing data without external leakage.

- 5. D Patterns of repeat neglect may prompt charter revocations as ultimate penalty.

Questions: Additional Guidance

-

- 1. Where find latest rulemaking updates and alerts?

- A) State regulators

- B) IRS website

- C) FinCEN site

- D) Reporting company queries

- 2. How can complex scenarios get clarified confidentially?

- A) External legal counsel

- B) Secure government webforms

- C) Private investigator research

- D) Anonymous media tips

- 3. What future improvements aim easing reporting burdens?

- A) Distributed ledger sourcing

- B) Artificial intelligence aids

- C) Blanket exemptions

- D) Interagency auto-populations

- 4. Why monitor international reporting regimes?

- A) Learning leading practices

- B) Identifying jurisdictional arbitrage

- C) Qualifying for exemptions

- D) Perpetual collaboration needs

- 5. How ease transparency rules learning curves?

- A) Advisory committee feedback

- B) Mass notification alerts

- C) Funding assistance to smaller firms

- D) Technology solution adoption incentives

- 1. Where find latest rulemaking updates and alerts?

Answers:

-

- 1. C The FinCEN website serves as central repository for all official rulemaking updates and alerts.

- 2. B Secure government webforms enable confidential inquiry submissions to get authoritative responses.

- 3. A Distributed ledger based ownership sourcing integration aims easing validation burdens over time.

- 4. D Perpetual international reporting regime collaboration needs justify ongoing monitoring to identify gaps.

- 5. C Targeted financial assistance to smaller firms balances resource constraints hindering compliance.

Disclaimer on Corporate Transparency Act Analysis

This article aims to summarize central components of beneficial ownership reporting requirements instituted under the Corporate Transparency Act. However, it does not constitute formal legal guidance and details are subject to change. All businesses should consult attorneys to address specific questions on disclosure rules and ensure compliance best practices tailored to their situations.