Are you a licensed psychologist in California considering forming a professional corporation? This comprehensive guide outlines the benefits, including liability protection and potential tax savings, and provides essential steps for setting up a professional psychology corporation in the state. It's a must-read for any practitioner seeking to enhance their practice's legal and financial footing.

by Zach Javdan

December 5, 2023

Are you a licensed psychologist running your own private practice in California, looking to limit personal liability while potentially saving on taxes? If so, creating a professional psychology corporation could be a prudent move.

Registering as a professional corporation and electing S-corp status with the IRS opens up significant payroll tax savings as income passes through to you personally. This can boost your bottom line compared to a sole proprietorship.

Additional perks include continuity if you ever want to bring on a partner or sell your practice. Patients may also perceive an incorporated structure as more established and prestigious.

Malpractice claims cannot be avoided by incorporating, but a corporate shield can defend against contractual issues, employee disputes, or other legal matters not related to professional services.

As straightforward as it sounds, the paperwork, filings and regulations involved in properly forming and registering a psychology corporation in California have tripped up many well-intentioned practitioners.

Consulting with an experienced incorporation attorney can pay dividends by handling the bureaucratic legwork from start to finish. This leaves you free to focus on clients rather than getting bogged down in red tape.

Consult with a California Incorporation Attorney

Taking the DIY route in forming a psychology corporation can be tempting for many practitioners.

Yet, this approach can stumble at the registration stage, as the corret paperwork needed can be tricky terrain.

Why not channel your time into what you do best and leave the complex paperwork to a seasoned professional in California business formation?

When to Form a California Psychology Corporation

Is it better to incorporate your psychology practice at the start of a new tax year? Are there any filing deadlines to consider?

These are important questions to review with your business formation specialist. The timing of your corporation filing can impact tax planning and compliance.

California Psychologists Cannot Practice Using LLCs

Psychologists in California are prohibited from practicing under a Limited Liability Company (LLC) structure pursuant to Section 2156.5 of the Business & Professions Code.

This statute restricts psychologists, along with physicians, dentists, and other licensed professionals, from limiting personal liability via an LLC in association with their clinical practice.

Psychologists are mandated to form a professional psychology corporation certified by the California Secretary of State and registered with the California Board of Psychology in order to limit liability exposure.

Are you Eligible to Form a California Psychological Corporation?

When structuring a professional psychology corporation in California, you need to follow specific rules concerning shareholders and corporate leadership roles.

Here’s the breakdown based on number of shareholders, according to California Corporations Code section 13403:

Single Shareholder Scenario: With only one shareholder, this person is the director, president, and treasurer of the corporation.

Two Shareholder Scenario: With two shareholders, both serve as directors, dividing the roles of president, vice president, secretary, and treasurer between them.

Share Issuance: At least 51% of shares must be owned by licensed psychologists. The rest can go to nurses, physicians, etc. Shares get transferred back to the corporation if an owner loses licensing eligibility.

To operate legally, the corporation must be comply with the Moscone-Knox Professional Corporation Act. This ensures adherence to high professional standards and ethical practices within the field of psychology in California.

Advancing Professionalism: California psychologists are increasingly turning to professional corporations to elevate their practices and safeguard their futures.

Buy-Sell Agreements For Multi-Shareholder California Psychology Corporations

Once your psychology corporation involves multiple shareholders, implementing a buy-sell agreement is critical.

Also known as a shareholder’s agreement, this legally binding contract lays out what happens if a stakeholder dies, becomes incapacitated, divorces or wants to exit the corporation.

Without one, you could end up in a messy situation if the unexpected occurs. For example, shares could fall into the hands of a non-psychologist heir against your will.

Hiring a business attorney well-versed in California corporation law is wise. They can draft a customized buy-sell agreement outlining the transfer or sale of shares between remaining stakeholders if trigger events occur.

This helps you avoid chaos and costly disputes down the road while keeping your corporation compliant. So don’t neglect this crucial governance document.

C Corp vs. S Corp: Which Tax Status is Better for a CA Psychology Corporation?

When forming your professional psychology corporation in California, you’ll need to make an important tax decision – whether to be taxed under subchapter C or subchapter S of the federal tax code.

C corporation status is the default if you don’t file anything with the IRS. This means your corporation pays taxes on net income. Then you pay personal tax again on profits distributed to you.

With S corporation status, income, losses, deductions and credits pass through to your personal tax return. So you avoid “double taxation” but still get liability protection.

To elect S corp status, submit IRS Form 2553 within 2 months and 15 days from your incorporation date in California.

The benefits of S corporation flow-through taxation often make it the right choice for psychology corporations. But every situation is unique, so discuss in-depth with your tax professional.

Naming Requirements for California Psychology Corporations

Picking the perfect name for your California psychology corporation goes beyond personal preference – it’s legally restricted.

According to Cal. Bus. & Prof. Code § 2998, the name must contain at least one of the following psychology-related words specified in Cal. Bus. & Prof. Code § 2902(c):

- Psychology

- Psychological

- Psychologist

- Psychology consultation

- Psychology consultant

- Psychometry

- Psychometrics

- Psychometrist

- Psychotherapy

- Psychotherapist

- Psychoanalysis

- Psychoanalyst

You’ll also need a corporate designator like “Corp.,” “Incorporated,” “Inc.,” or “Professional Corporation.”

Additionally, avoid anything misleading or too similar to existing businesses. Approval is required for restricted words like “bank.”

The name should accurately reflect your psychology services while aligning with all California corporation naming laws.

Connecting with a business formation pro can help ensure your selected psychology corporation name checks all the legal boxes before solidifying your brand identity.

Selecting a Registered Agent for Your California Psychology Corporation

Under California law, all corporations must designate a registered agent to receive important legal documents like lawsuits or subpoenas. This agent needs to be available at a physical California address during normal business hours.

You could name someone internally like a director or officer to take on this duty. However, skipping town during a lawsuit could mean losing a case by default. Not an ideal scenario!

Many psychology corporation owners hire a professional registered agent service for convenience and extra privacy. They’ll handle all your legal mail without tying you to the office. This also keeps your home address off public records.

So when forming your corporation, ensure you or your designated agent can receive legal documents at a California business address from 9-to-5. If not, consider hiring a registered agent service provider.

File Articles of Incorporation

The first step in creating a California Accountancy Corporation is filing the Articles of Incorporation of a Professional Corporation with the California Secretary of State. This document is pivotal as it officially marks the registration of your corporation with the state. The details to be included in the Articles of Incorporation are numerous yet crucial for legal compliance.

Start with the name of the Accountancy Corporation, ensuring it complies with the naming guidelines set for accountancy corporations in California. Next, state the principal business address where your corporation will be operating. Mention the name and address of the individual or entity appointed as the Agent for Service of Process to receive legal documents on behalf of your corporation.

It’s also necessary to specify the number of shares your corporation is authorized to issue, representing the ownership portions of your corporation. Most importantly, clearly articulate that the purpose of the corporation is to provide accountancy services, as per California law, to avoid any misinterpretations.

Accurate completion and filing of the Articles of Incorporation are of paramount importance to lay a solid legal foundation for your accountancy corporation. Hence, consulting an attorney acquainted with California business formation regulations is advisable to ensure all details are correctly handled from the outset.

Creating Organizational Minutes for California Psychology Corporations

After your psychology corporation is registered in California, drafting organizational corporate minutes is highly recommended.

These internal records name your initial officers and directors while memorializing key details from your Articles of Incorporation.

Although just a formality, having these on file demonstrates you’re following corporate formalities in California. This can be invaluable if you ever end up in court.

You should also prepare annual minutes recapping major corporate decisions per CA Corporation Code §1500. Ongoing records help prove your adherence to laws.

Carefully drafting and safely storing your psychology corporation’s minutes helps maintain legal validity and shields you from scrutiny.

Crafting Robust Bylaws for California Psychological Corporations

When establishing a psychology corporation in California, robust bylaws are critical for smooth operations and legal compliance.

These governing documents should cover details like shareholder meeting schedules, voting rules, director and officer powers, record-keeping policies, stock issuance procedures, and registered agent information.

These legally binding governing documents should cover:

- Meetings: Shareholder meeting logistics like when meetings are held, meeting notice requirements, voting procedures, and quorum rules.

- Officers: Powers, roles and election procedures for corporate directors and officers.

- Records: Policies for keeping and accessing important records like meeting minutes, stock ledgers, licenses, contracts etc.

- Stock: Procedures for issuing and transferring shares of corporate stock.

- Agent: Registered office and agent information.

- Accounting: Fiscal year dates and accounting methods.

- Amendments: Amendment procedures allowing modifications to the bylaws.

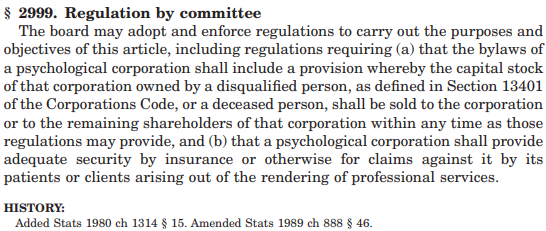

Additionally, bylaws must include the following provision mandated by Business & Professions Code §2999:

“The capital stock of that corporation owned by a disqualified person, as defined in Section 13401 of the Corporations Code, or a deceased person, shall be sold to the corporation or to the remaining shareholders of that corporation within any time as those regulations may provide.”

Having detailed bylaws not only facilitates smooth operations, but also demonstrates to regulators and courts that your corporation meets California’s legal governance standards.

Issuing Stock to Shareholders of California Psychology Corporations

Documenting share ownership is vital when forming your psychology corporation. Stock certificates formally designate each shareholder’s percentage of ownership.

These records should include the corp name, shareholder names, number of shares issued, total authorized shares, issuance dates, and signatures of the president and secretary.

Stock certificates must also reference applicable restrictions around ownership and transfers to comply with CA Corporation Code §300-313.

Correctly documenting and limiting share ownership ensures regulatory adherence and legal protection.

Maintaining a Stock Ledger for Your California Psychology Corporation

In addition to stock certificates, keep a corporate stock ledger recording all original issuances and subsequent share transfers.

This historical record will include:

- Names of shareholders

- Number of shares issued

- Dates shares were acquired

If shares change hands (as permitted by law), ledger updates maintain accurate ownership documentation.

Leading by Example: In the heart of California, psychologists are redefining the landscape of mental health through innovative practices and professional excellence.

Obtaining an EIN for Your California Psychology Corporation

After registering your psychology corporation, request a federal Employer Identification Number (EIN) from the IRS.

This unique tax ID number essentially functions as your business’s Social Security Number used to track tax filings and open business bank accounts.

You can submit IRS Form SS-4 or conveniently request an EIN online.

Review the IRS instructions for Form SS-4 if you have questions on filling it out.

Having an EIN is essential for federal tax compliance as well as opening business bank accounts.

Filing for S Corporation Status with the IRS

To have your California psychology corporation taxed as an S corporation, file IRS Form 2553 within 2 months and 15 days from your incorporation date.

This federal tax election allows business income, losses, deductions and credits to “pass through” to your personal tax return.

The form requires your corporation’s name, address, EIN, shareholders’ info, and details about anyone holding community property interests.

Consult the Form 2553 instructions published by the IRS if you need help filling it out accurately.

Filing a Statement of Information with the CA Secretary of State

Within 90 days of incorporating your psychology corporation, you must file an initial Statement of Information form with the California Secretary of State.

This document discloses your entity number, business address, mailing address, officers, directors, registered agent, and type of business.

There is a $25 filing fee plus $5 more if you want an official certified copy. Remember to file an updated Statement annually to avoid penalties and remain compliant.

Failing to meet the 90-day initial deadline can lead to a suspended corporate status and a hefty $250 penalty from the state.

So be sure to calendar this important requirement that keeps your corporation in good legal standing.

Importance of Filing a Limited Offering Exemption in California

Within 15 calendar days after first issuing any stock, California corporations must file a Notice of Transaction Pursuant to a Limited Offering Exemption with the Department of Financial Protection and Innovation (DFPI).

This crucial filing essentially notifies the State of California that your corporation is exempted from full securities regulation because shares are not being offered to the general public.

To file, you must submit a completed Form 25102(f) along with the required fee to the DFPI.

The typical filing fee is:

- $350 for stock valued at $1 million or more

- $275 for stock valued between $500K – $999K

- $150 for stock valued between $100K – $499K

- $25 for stock valued less than $25K

Submitting this required notice spares your corporation from much more complex securities filings and regulations associated with public stock offerings.

Setting up a Dedicated California Corporation Bank Account

Shortly after receiving your Entity Number, establish a separate business bank account under your psychology corporation’s name and tax ID number (EIN). This dedicated account should be used exclusively for depositing client income and paying business expenses.

Strict separation of corporate and personal finances is crucial to preserve your liability shield. Co-mingling funds or using one account for both purposes can potentially lead courts to “pierce the corporate veil” if owners are sued or audited, making them personally responsible for company debts and liabilities.

Additionally, initial corporate account deposits should precisely match equity stock purchase amounts reflected in your company Stock Ledger. This demonstrates you are properly tracking shareholder contributions and not intertwining capital with earned revenue.

By dedicating business bank accounts solely for your practice’s corporate financial flows, you reinforce limited liability provisions incorporated under state law.

Be sure to also notify payment processors your corporation uses, such as billing systems and merchant services, to keep invoices paid from protected accounts rather than personal means.

Navigating the Local Licensing Landscape for California Corporations

Following completion of state-level formation requirements, turn focus to county and city jurisdictions your psychology corporation will maintain facilities or serve patients in.

The California CalGOLD website conveniently compiles licensing authorities on a local level, specifying individual documentation and renewal procedures political subdivisions mandate.

Common examples include municipal business operation permits, county health screenings, local fire & safety certificates, city-specific revenue licenses, California BOE sales permits, and state or county professional clearances.

Failure to secure required licenses can disrupt practice activities through denied facility access, revoked contractor status, prohibited enrollment with insurance providers, or even civil penalties levied.

So properly identifying and maintaining applicable permits across multiple government levels is imperative for seamless legal compliance and service delivery.

Visionary Minds at Work: California’s psychologists blend deep insight with compassion, shaping the future of mental wellness one patient at a time.

Complying with the Federal Corporate Transparency Act (CTA)

A major regulatory change takes effect on January 1, 2024 that will impact all California professional corporations – the federal Corporate Transparency Act (CTA).

This law, enacted in 2021, requires nearly all state-registered corporations and LLCs to disclose current “beneficial owners” and “company applicants” to the federal Financial Crimes Enforcement Network (FinCEN) database.

Beneficial owners refer to individuals who exercise substantial control over a company or receive substantial economic benefits from ownership interests. And company applicants are those who file formal registration papers even if not owners.

CTA disclosures aim to prevent financial crimes like money laundering, tax evasion, terror financing, trafficking, and more by illuminating covert company ownership structures.

Willful failure to report accurate beneficial ownership information carries severe civil and criminal penalties, including up to $500 per day late fees (capped at $10,000), and prison time up to 2 years.

So all California psychology corporations must take proactive steps to comply with federal transparency rules when provisions take effect in 2024.

Speak with an attorney to understand exact requirements and reporting procedures to avoid noncompliance.

Allow Our California Attorneys to Guide Your Corporation Formation

With so many intricate steps involved, forming a psychology corporation correctly can get complex for busy practitioners.

That’s why thousands of individuals have worked with LawInc to incorporate smoothly and efficiently.

We offer unmatched expertise when it comes to launching California compliant corporations.

Click below to start your psychology corporation securely online or call (310) 765-2525 for a free attorney consultation:

Contact Us for Help With any Other Legal Services

Beyond formations, LawInc can connect psychology professionals with expert attorneys specializing in buying & selling practices, independent contractor reviews, HIPAA compliance, litigation defense and more. Reach out if you need top-tier legal guidance tailored to the needs of California behavioral health providers.

Also See: