Businesses must now prepare for reinstated Corporate Transparency Act reporting requirements with new extended deadlines. Take immediate action to compile beneficial ownership information and ensure compliance before the January 13, 2025 filing date.

by Zach Javdan

December 23, 2024

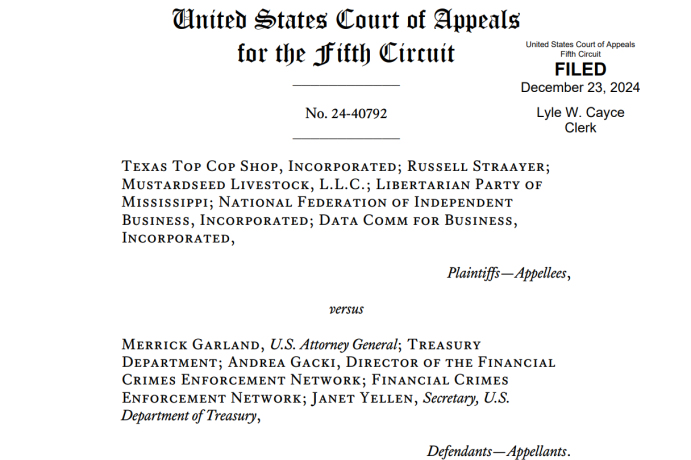

On December 23, 2024, the U.S. Court of Appeals for the Fifth Circuit granted the federal government’s request to stay the December 3rd nationwide injunction against the Corporate Transparency Act (CTA). As a result, the CTA’s Beneficial Ownership Information (BOI) reporting requirements are back—albeit with newly extended deadlines announced by FinCEN.

Here’s the latest on what it means for your business:

1. Fifth Circuit Lifts Nationwide Injunction

- CTA Enforcement Resumes: The Fifth Circuit’s Dec. 23 order put the CTA back into effect. The earlier ruling by a Texas federal court had halted the CTA nationwide, but that order is now on hold pending appeal.

- What’s Next? The legal battle continues at the appellate level, so more changes could come. But for now, the CTA is enforceable again.

Example Implication:

- Any company that was waiting or ignoring the CTA obligations based on the injunction must now prepare to file BOI data by the new deadlines, unless exempt.

How to Proceed:

- Confirm whether you’re classified as a “reporting company.” If so, note the new dates (below) and plan accordingly.

- Monitor official announcements from FinCEN and your legal counsel for updates, as appeals are ongoing.

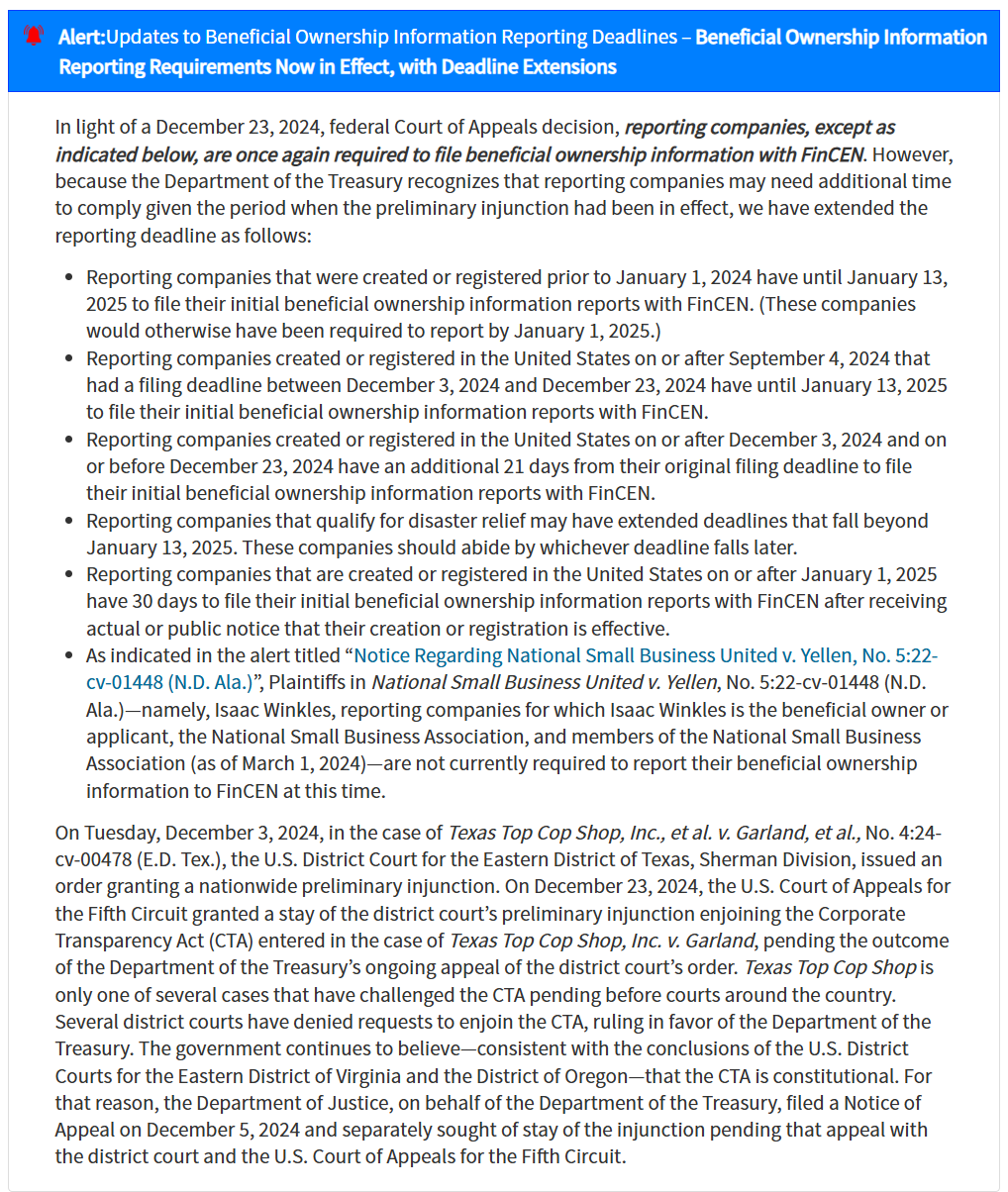

2. FinCEN’s Updated Deadlines & Guidance

- Extended Filing Dates: To account for the earlier injunction, FinCEN has changed the reporting schedule. Pre-2024 entities now have until January 13, 2025 (instead of Jan. 1) to submit their initial BOI reports.

- Extra Time for Some New Formations: Companies formed or registered after December 3, 2024 may have an additional 21 days beyond the standard 30-day rule, depending on their formation date and any prior missed deadlines.

- NSBU Plaintiffs Exemption: If you’re a plaintiff or member in National Small Business United v. Yellen, FinCEN’s notice states you remain exempt from filing for now.

Examples of Adjusted Deadlines:

- A pre-2024 reporting company that was originally due on Jan. 1, 2025, now must file by Jan. 13, 2025.

- An entity formed on Dec. 10, 2024 may get an additional 21 days beyond its usual 30-day window.

How to Proceed:

- Check FinCEN’s official CTA page to confirm your exact deadline.

- Prepare all beneficial ownership details (including addresses, ID info, etc.) now, even if you believe you might be exempt.

- Consult legal counsel if your company formed between Dec. 3 and Dec. 23, 2024 to confirm your new deadline.

3. Reporting Requirements at a Glance

- Who Files? Most LLCs, corporations, or similar entities formed in the U.S. or registered to do business here (unless exempt under the CTA).

- What’s Required? Full legal name, date of birth, address, and an acceptable ID number (e.g., driver’s license) for each beneficial owner, plus entity details.

- Updates: If your beneficial ownership changes, typically you must file an updated BOI within 30 days, subject to these new extended deadlines if they apply.

Practice Tip:

- If you already filed, ensure you keep track of any owner changes. Any new updates must be reported within 30 days (or the extended period if eligible).

- If you have not filed yet, compile all beneficial ownership data in one place to speed up e-filing when ready.

How to Proceed:

- If you’re unsure about your status or timing, double-check with a legal or compliance professional.

- Mark your calendar with the new extended filing date if you formed your business before Jan. 1, 2024, or if you’re in that Dec. 3 – Dec. 23 formation window.

Summary

Did You Know? FinCEN extended the original Jan. 1 deadline to Jan. 13, 2025, for many pre-2024 reporting companies. The CTA is now fully back in effect for everyone but certain litigants in the NSBU lawsuit.

With the CTA’s BOI reporting requirements reinstated, businesses must heed the new extended deadlines from FinCEN. More legal twists are possible as the appeal progresses, but for now, start preparing your BOI filings if you haven’t already. Keep a close eye on any further announcements in the days ahead.

Key Takeaways:

- The Fifth Circuit stayed the Texas nationwide injunction, making the CTA enforceable again.

- FinCEN provides extended filing deadlines, with many pre-2024 entities now due by Jan. 13, 2025.

- Litigation remains ongoing—further changes are possible, but for now, BOI reporting is back.

Test Your CTA Knowledge

Questions

- Which court reinstated the CTA requirements on Dec. 23, 2024?

- A) District Court for the Eastern District of Texas

- B) Fifth Circuit Court of Appeals

- C) Supreme Court

- D) Eleventh Circuit

- When is the new extended deadline for most pre-2024 reporting companies?

- A) January 1, 2025

- B) December 23, 2024

- C) January 13, 2025

- D) March 1, 2025

Answers

- 1. B) The Fifth Circuit Court of Appeals

- 2. C) January 13, 2025

Also See

Corporate Transparency Act Bombshell: Why Your Business Needs to Act NOW

Corporate Transparency Act Chaos: Why 32 Million Businesses Are in Limbo