by Sheren Javdan

April 24, 2014

Ondot Systems Inc., a California corporation based out of San Jose, has revolutionized the credit card. The startup company was first found by Vaduvur Bharghavan in 2011 and has raised $18 million in funding since.

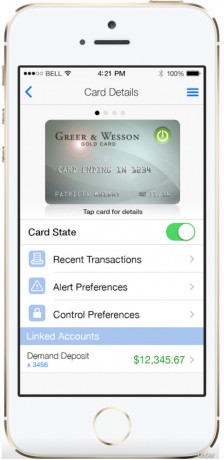

After being in stealth mode for a few years, Ondot has recently teamed up with the top credit card processors that handle credit, debit, and prepaid cards in addition to over 10,000 banks across the U.S. With its new partnership, the startup plans to provide a single application that users can use to remotely manage all features of their existing cards.

As all cardholders know, managing several different credit cards is difficult and annoying. Specifically, when a user’s wallet gets lost or stolen. Cardholders spend several hours trying to first remember what bank they hold a card with and another few hours getting a hold of a live person who can help cancel their card. Once finished, users must repeat the process for every card they have lost.

Furthermore, employers and parents who let their employees and or children borrow the cards have no control over the borrower’s spending until it is too late, that is, once the statement is already posted and the charges have been processed. That situation makes things even more difficult.

For example, if a card is used outside the set geographical location, any transaction is automatically denied. Cardholders then receive an instant notification and are able to lock their card.

The new application is brilliant for Banks who lose billions of dollars a year to fraud. In 2012, banks lost over $11 billion in fraud related losses. With an average of 52 days before customers detect any fraud, banks have a lot to lose. An Ondot primary partner, Lone Star National Bank (LSNB), has been using the startup application for the past year.

As a result, LSNB has reported 60% less fraud, 54% more card use, and 48% more card spending by their users. “With CardControl, we were able to decrease our fraud losses from $450,000 in 2012 to $180,000 in 2013” said David Penoli, LSNB’s COO.

What the startup company is doing is revolutionizing the card industry. By bundling all aspects of a credit card into one simple mobile phone application, Ondot is giving users come peace of mind. Not only does the startup provide peace of mind for cardholders, but it also protects the card issuers from fraud related expenses and inconveniences as well.

Topics: Apps, Small Business, Startups