Forming a Professional Acupuncture Corporation in California requires understanding strict ownership rules, licensing requirements, and corporate formalities. Follow this guide to ensure compliance, avoid legal pitfalls, and build a legally sound acupuncture practice.

by Zach Javdan

March 5, 2025

Forming and operating a Professional Acupuncture Corporation in California involves managing a specialized set of rules, regulations, and best practices. From naming requirements to ownership restrictions, this guide will walk you through the core essentials of establishing your California Professional Acupuncture Corporation (PAC). We’ll also cover compliance tips, potential pitfalls, and frequently asked questions, so you can confidently build a thriving acupuncture practice that stands on solid legal ground.

1. Understand California’s Professional Corporation Rules for Acupuncturists

-

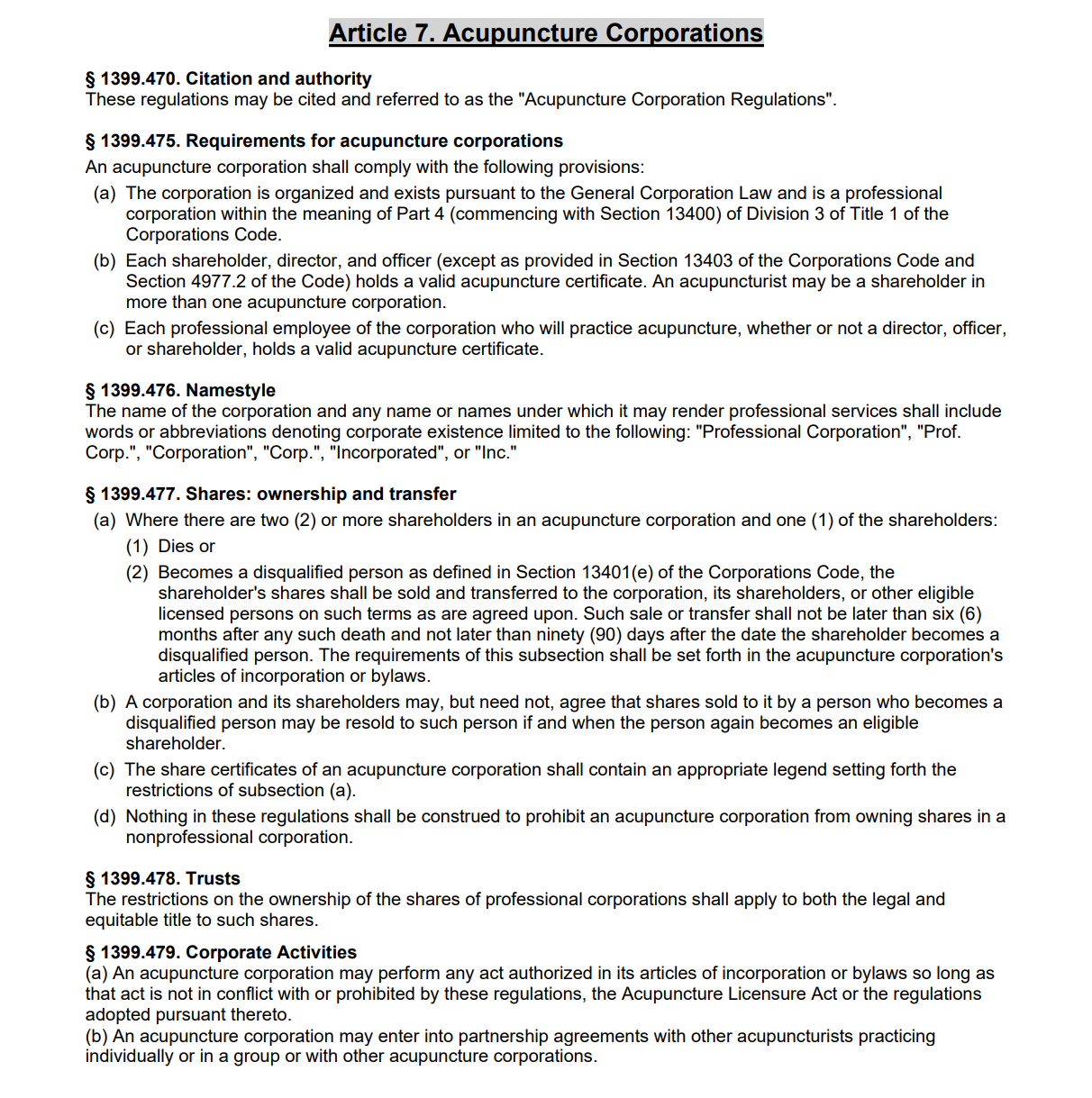

- Professional Corporation Defined: A corporation formed pursuant to California’s Moscone-Knox Professional Corporation Act (Cal. Corp. Code §§13400–13410) to provide professional services by individuals duly licensed by the state.

- Acupuncture Board Oversight: California acupuncturists are regulated by the California Acupuncture Board. Your corporation must abide by both the Board’s regulations and the state’s professional corporation statutes.

- Specific Licensing Requirements: Each licensed acupuncturist who is a shareholder, director, or officer must hold a valid and active California acupuncture license.

- Ownership Restrictions: Typically, the owners (shareholders) of a Professional Acupuncture Corporation must be licensed acupuncturists. However, California law permits certain other licensed healing arts professionals to own shares in the corporation, provided their combined ownership does not exceed 49%. These professionals include:

- Licensed physicians and surgeons

- Licensed doctors of podiatric medicine

- Licensed psychologists

- Registered nurses

- Licensed optometrists

- Licensed marriage and family therapists

- Licensed clinical social workers

- Licensed physician assistants

- Licensed chiropractors

- Naturopathic doctors

- Licensed professional clinical counselors

- Licensed midwives

Note: All non-acupuncturist shareholders, taken together, generally may not hold more than 49% of the corporation’s stock.

- Scope of Practice: A Professional Acupuncture Corporation may only provide services within the authorized scope of acupuncture, including Traditional Chinese Medicine (TCM), herbal counseling, and adjunctive therapies recognized by the Acupuncture Board.

Examples:

-

- Dr. Tang, L.Ac., forms a Professional Acupuncture Corporation in Los Angeles with two acupuncturist colleagues. Each holds an equal 33.3% share.

- Wei, a licensed acupuncturist, partners with one chiropractor (D.C.) who holds 20% ownership, keeping under the 49% limit for non-acupuncturist health professionals.

- Amy, L.Ac., discovered that her friend (an unlicensed investor) cannot hold shares in her corporation due to California’s professional ownership rules.

How to Proceed:

-

- Confirm each shareholder’s license is current and in good standing with the California Acupuncture Board.

- Review Cal. Corp. Code §§13400–13410 to ensure you understand the legal framework for your professional corporation.

- If co-owning with other healing arts professionals, verify their license types and keep non-acupuncturist shares below 49%.

- Consult a lawyer who specializes in healthcare or professional corporations to structure your PAC correctly.

FAQs:

-

- Can an unlicensed individual invest in my Professional Acupuncture Corporation? Generally no; shareholders must hold professional licenses, with very limited exceptions.

- Do all directors and officers also have to be licensed? Yes, each director, the president, vice-president, secretary, and treasurer typically must hold an active acupuncture license or other valid license if permissible by law.

- What happens if a shareholder’s acupuncture license is suspended? They must immediately stop practicing and divest their shares if their license isn’t reinstated promptly.

- Does a Professional Acupuncture Corporation need a separate business license? You’ll need to check with your local city/county for business tax certificates or local practice permits in addition to forming your PAC at the state level.

2. Naming Your Professional Acupuncture Corporation

- Corporation Name Requirements: Per state regulations, you must include language such as “Inc.,“ “Corp.,“ “Professional Corporation,” “Prof. Corp.,” or abbreviations like “P.C.” in your legal name, along with designations referencing your acupuncture practice (e.g., “Acupuncture,” “AcuHealth,” etc.).

- Avoid Misleading Terms: Don’t imply you offer services outside acupuncture or TCM. Words like “Medical,” “Chiropractic,” or “Physical Therapy” should only be used if those licensed professionals are co-owners.

- Distinctiveness: The proposed name must be distinguishable from other California entities on record. Perform a name availability search with the California Secretary of State.

Examples:

-

- “Harmony Point Acupuncture P.C.” – Acceptable name featuring both “Acupuncture” and “P.C.”

- “Li Acupuncture & TCM Prof. Corp.” – Reflects the nature of the practice and corporate designation.

- “Western Medicine & Acupuncture, Inc.” – Could be misleading unless the corporation is co-owned by a licensed M.D., so verify compliance first.

How to Proceed:

-

- Brainstorm names that clearly indicate your acupuncture services without misleading the public about the licensed professionals involved.

- Conduct a name search on the California Secretary of State’s website or hire a service to confirm the name’s availability.

- Add “Professional Corporation,” “Prof. Corp.,” “P.C.,” or another compliant suffix when preparing formation documents.

- Lock in your corporate name by filing the required formation documents promptly once you’ve checked availability.

FAQs:

-

- Can I reserve my corporation name before filing? Yes, you may reserve a name for up to 60 days by submitting a Name Reservation Request form with the Secretary of State.

- Do I have to use “Acupuncture” in my name? You must reference the nature of your professional services (acupuncture), but you can also use terms like “TCM” or “Traditional Chinese Medicine” if they are not misleading.

- Should my corporate name match my DBA/fictitious name? Consistency helps avoid confusion, but you can also file a fictitious business name (“doing business as”) if desired.

3. Filing & Formation: Step-by-Step

- Draft Articles of Incorporation (Form ARTS-PC): Include the professional purpose (acupuncture) and the designated corporate name. File with the California Secretary of State.

- Appoint a Registered Agent: You must list an individual or a registered agent service with a physical California address to receive legal documents.

- Create Bylaws: Outline how the corporation will be governed: shareholder meetings, officer duties, ownership of shares, etc. Must be consistent with professional corporation rules.

- Hold Organizational Meeting: Adopt bylaws, elect officers/directors, issue shares, and document everything in corporate minutes.

- Obtain Required Licenses & Permits: Beyond the acupuncture license, check city business licenses and professional liability insurance requirements.

Sample Filing Checklist Chart

| Formation Step | Document/Form | Notes |

|---|---|---|

| 1. Articles of Incorporation | Form ARTS-PC | Filed with California Secretary of State |

| 2. Registered Agent | Statement of Info (SI-PC) | Must have a physical address in CA |

| 3. Bylaws Drafted | N/A (Internal Document) | Must comply with CA Professional Corp. requirements |

| 4. Stock Issuance | Stock Certificates, Shareholder Agreement | Shares can only be held by licensed professionals |

| 5. Licensing & Permits | City/County Business License, Acupuncture Board | Ensure compliance with local and state boards |

How to Proceed:

-

- File your Articles of Incorporation online or by mail. Retain proof of filing for your records.

- Draft bylaws specific to professional corporations. Consider consulting a lawyer for compliance nuances.

- Issue shares only to those allowed by law (primarily licensed acupuncturists).

- Obtain any required local business permits in your city or county of operation.

FAQs:

-

- Is an organizational meeting mandatory? While not always required by statute, holding one and documenting corporate formalities help protect your liability shield.

- Can I form an LLC for my acupuncture practice? No. California does not allow licensed professionals to practice under an LLC. A Professional Corporation is the standard vehicle for licensed acupuncturists.

- What if I forget to file the Statement of Information? The Secretary of State can impose fines and eventually suspend your corporation if you fail to file timely updates.

4. Compliance Obligations & Best Practices

- Corporate Formalities: Hold regular board meetings, document key decisions in minutes, keep corporate records current, and file biennial Statements of Information.

- Professional Liability Insurance (Malpractice Insurance): While not always mandated by law, it’s strongly advised to protect against malpractice claims.

- Ethical Advertising: All marketing must comply with the Acupuncture Board’s guidelines. Avoid exaggerated claims or misleading statements regarding patient outcomes.

- Patient Confidentiality: Follow HIPAA guidelines (if applicable) and ensure you maintain secure patient records and privacy protocols.

- Renew Licenses and Stay Current: Ensure that all licensed officers/shareholders maintain active acupuncture licenses and complete continuing education requirements on time.

Examples:

-

- Kim’s corporation got suspended after missing the biennial Statement of Information filing. She had to pay a penalty to reinstate good standing.

- Li Acupuncture Prof. Corp. invests in a robust malpractice policy, which covers licensed employees as well as the entity itself.

- Bee’s TCM Prof. Corp. uses HIPAA-compliant software to manage patient files, reducing the risk of privacy breaches.

How to Proceed:

-

- Set calendar reminders for key filing deadlines, like annual/biennial reports and license renewals.

- Maintain a thorough corporate records book that includes minutes, bylaws, share ledgers, and all official filings.

- Review malpractice insurance options annually to ensure coverage matches your practice’s current scope.

- Regularly monitor the California Acupuncture Board’s updates for any changes in advertising rules or other regulations.

FAQs:

-

- Is malpractice insurance legally required? There’s no universal mandate, but some hospitals or health networks may require it if you practice within their facilities. It’s strongly recommended regardless.

- Are continuing education hours part of corporate compliance? CE hours apply to individual practitioners, not the corporation itself, but failing to meet them can jeopardize your professional license, which affects your corporation.

- Does HIPAA apply to acupuncturists? If you bill electronically or handle protected health information in certain ways, HIPAA may apply. Consult a healthcare attorney if unsure.

5. Tax & Financial Considerations

- Entity Classification: Most Professional Acupuncture Corporations choose either an S-Corporation or C-Corporation status for federal tax. Consult a CPA to decide which is optimal for your practice’s income level and goals.

- California Franchise Tax: PACs pay the annual California franchise tax (minimum $800) plus any taxes on net income, if applicable.

- Shareholder Compensation: Must be “reasonable” if claiming S-Corp tax treatment. Excessive draws or distributions can trigger IRS scrutiny.

- Employee vs. Independent Contractor Status: Properly classify your staff (including other licensed acupuncturists) to avoid issues with California’s strict employment laws (e.g., AB5).

Chart: S-Corp vs. C-Corp Key Differences

| Factor | S-Corp | C-Corp |

|---|---|---|

| Taxation | Pass-through taxation, profits taxed at shareholder level | Double taxation, profits taxed at corporate and shareholder levels |

| Owner Limit | Limited to 100 U.S. individual shareholders | No limit on number or type of shareholders |

| Flexibility | Less flexible for equity structuring (one class of stock) | More flexibility with multiple classes of stock |

| Ideal For | Small-med sized practices seeking to avoid double tax | Larger, growth-oriented corporations |

How to Proceed:

-

- Discuss your tax strategy with a CPA familiar with professional corporations and healthcare providers.

- File the appropriate S-Corp election (Form 2553) if choosing S-Corp status. Adhere to all deadlines.

- Keep impeccable payroll and tax records to remain in good standing with the IRS and FTB.

- Ensure your staff are classified properly as employees vs. independent contractors under AB5 and relevant labor laws.

FAQs:

-

- Which tax structure is best for my acupuncture practice? It depends on your practice size, profit margins, growth plans, and other financial goals. A specialized CPA can guide you.

- Will I always owe at least $800 per year to California? Yes, that’s the minimum franchise tax for corporations, even if you have zero profits.

- Can I pay myself all the profits as a distribution to avoid payroll taxes? The IRS requires “reasonable compensation” for shareholder-employees. Paying yourself a token salary may trigger an audit.

6. Consider Hiring a Legal/Corporate Compliance Professional

- Specialized Knowledge: Healthcare and professional corporation law is nuanced, and mistakes can cost you big in fines or even license suspension.

- Mitigate Risk: A seasoned attorney can reduce liability risks, ensure compliance, and help navigate ownership transitions or disputes.

- Ongoing Guidance: As your acupuncture practice grows, you may need help with contracts, lease agreements, expansions, and new shareholders.

Examples:

-

- Olivia’s attorney helped negotiate a commercial lease for her new healing arts clinic, ensuring the landlord allowed minor TCM modifications to the space.

- When Dr. Wen brought on a second acupuncturist as a shareholder, her lawyer drafted a shareholders’ agreement to address buy-in terms and potential dissolution scenarios.

How to Proceed:

-

- Seek a free or low-cost consultation with a law firm experienced in professional corporations. Many attorneys offer initial case evaluations at no charge.

- Interview multiple attorneys or compliance specialists to find a good fit for your practice’s size and personality.

- Retain ongoing services or create a relationship with a professional you can call as questions or issues arise.

FAQs:

-

- Is a lawyer required to form a Professional Acupuncture Corporation? Not by law, but it’s highly recommended to avoid compliance mistakes.

- Should my accountant also know about professional corporations? Yes, a CPA with healthcare experience can structure your finances for maximum efficiency and minimum risk.

- What if I want to expand my services to herbal spa treatments or Chinese massage? Verify that any additional services are within the legal scope of practice and your malpractice coverage. Your attorney can assist.

Summary

Did You Know? Forming a Professional Corporation helps licensed acupuncturists limit personal liability and maintain compliance with strict California laws governing healthcare practices.

Establishing a California Professional Acupuncture Corporation (PAC) is a strategic move for licensed acupuncturists serious about safeguarding their practice and reputation. Compliance with the Moscone-Knox Professional Corporation Act, adhering to Acupuncture Board regulations, and observing corporate formalities can protect you from liability risks and regulatory fines.

From selecting the right name to properly issuing shares and meeting ongoing obligations, every step matters. It’s wise to collaborate with legal and financial professionals who grasp the complexities of healthcare entities and tax strategies. By taking the time to establish a solid corporate structure, your acupuncture practice will enjoy a stable foundation for growth—and a stronger shield against potential pitfalls.

Test Your Professional Acupuncture Corporation Knowledge

Questions: Forming & Operating a California Professional Acupuncture Corporation

- 1. Which of the following entities can a licensed acupuncturist in California NOT form for practicing acupuncture?

- A) Professional Corporation (PC)

- B) Limited Liability Company (LLC)

- C) S-Corporation (electing S status as a PC)

- D) Corporation (with PC compliance)

- 2. What is the minimum annual franchise tax for a California corporation?

- A) $0 if no profit is made

- B) $50

- C) $800

- D) $1,000

- 3. Why is an “organizational meeting” important?

- A) It’s required to form an LLC

- B) Helps adopt bylaws, elect officers, and issue shares properly

- C) Creates a shareholder gift exchange program

- D) Only needed if you have more than 2 shareholders

- 4. Who can generally own shares in a California Professional Acupuncture Corporation?

- A) Any California resident

- B) Only licensed acupuncturists (plus certain other licensed healing arts professionals under 49%)

- C) Unlicensed spouses or family members

- D) Anyone if corporate bylaws allow it

- 5. Which entity typically oversees the licensing and regulation of California acupuncturists?

- A) California Acupuncture Board

- B) California Department of Finance

- C) California Attorney General

- D) U.S. Food and Drug Administration

Answers: Forming & Operating a California Professional Acupuncture Corporation

- 1. B) California does NOT permit licensed professionals (like acupuncturists) to form LLCs for their practice.

- 2. C) All California corporations owe a minimum annual franchise tax of $800.

- 3. B) The organizational meeting finalizes key corporate actions like adopting bylaws, electing officers, and issuing shares.

- 4. B) Only licensed acupuncturists and certain other licensed professionals under 49% can own shares in a Professional Acupuncture Corporation.

- 5. A) The California Acupuncture Board oversees licensure and regulations for acupuncturists.

Also See

California Professional Corporations Demystified: A Clear Road Map for Smart Practitioners