The nationwide requirement for businesses to report beneficial ownership information has been temporarily suspended, once again, following a federal court injunction. Companies can still voluntarily submit their information to FinCEN, but face no penalties for non-filing while the order remains in effect.

by Zach Javdan

December 30, 2024

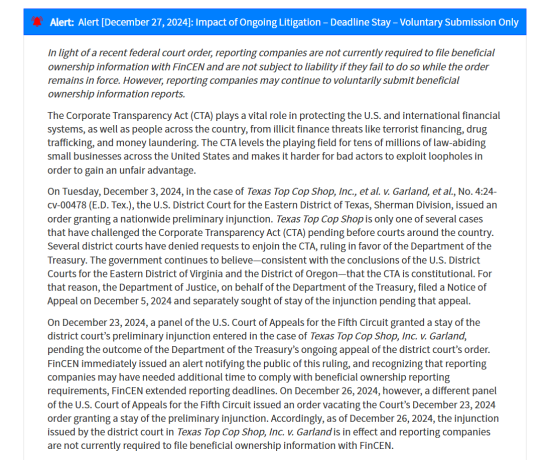

In the latest chapter of the Corporate Transparency Act (CTA) drama, the Financial Crimes Enforcement Network (FinCEN) has released a new “Red Alert” on December 27, 2024. According to FinCEN’s updated announcement, reporting companies are again not required to file their beneficial ownership information (BOI) after a series of rapid court reversals—unless they choose to do so voluntarily.

Below are the fresh details on FinCEN’s latest stance and how this development affects your compliance plans moving into 2025.

1. FinCEN’s New “Red Alert” Explained

- Reporting Not Required: Citing the recent court order that reinstated the injunction, FinCEN confirms that “reporting companies are not currently required to file.”

- Voluntary Filings Only: Companies may still submit BOI reports if they wish, but face no legal penalty for not doing so while the injunction is in force.

- National Impact: The alert applies nationwide, giving businesses a reprieve from the CTA’s short-lived, reinstated deadlines.

Examples:

- A family-owned LLC that hasn’t filed its initial BOI report is no longer at risk of missing a deadline if it chooses not to file right now.

- A startup that wants the certainty of having filed can do so voluntarily, but it’s not legally required.

How to Proceed:

- Review FinCEN’s updated guidance and keep a record of it for your compliance files.

- Decide whether voluntary filing makes strategic sense for your company—consult legal counsel if you’re unsure.

2. What Triggered This “Red Alert”?

- Court Injunction Resumes: After initially granting a stay of the district court’s injunction, the U.S. Court of Appeals for the Fifth Circuit vacated that stay on December 26, 2024, effectively restoring the CTA-wide injunction.

- FinCEN’s Rapid Response: FinCEN had previously reactivated CTA deadlines, but now, in light of the injunction’s return, it has reversed course to align with the court’s current order.

- Nationwide Pause: The Red Alert clarifies that no one must file while the injunction remains “in force,” pending the ongoing litigation.

Key Detail:

- The CTA remains under attack in multiple lawsuits, and this is only one significant example of different courts reaching conflicting positions.

How to Proceed:

- Track the official docket in Texas Top Cop Shop, Inc. v. Garland to see if the Fifth Circuit changes course again.

- Stay aware of any new FinCEN updates if the injunction is lifted or modified in the coming weeks.

3. How Does This Affect the Extended Deadlines Previously Announced?

- Deadline Extensions Mooted: The deadlines FinCEN extended (like January 13, 2025, for many preexisting companies) are effectively on hold until further court guidance.

- Voluntary Only: FinCEN’s current stance is that reporting is voluntary and there will be no liability for failing to file during this injunction period.

Example Scenario:

- If your company formed in mid-2024 planned to file by January 13, you currently aren’t obligated to meet that date—though nothing stops you from filing to get it over with.

How to Proceed:

- Maintain readiness to file should the injunction be lifted on short notice.

- Consult counsel about whether voluntary filing remains beneficial for your situation.

Summary

Did You Know? As of Dec. 27, 2024, FinCEN’s “Red Alert” states that CTA reporting is not mandatory while the court’s nationwide injunction stands.

Key Takeaways:

- The nationwide injunction is back in effect—requiring zero CTA reporting for all entities.

- Extended deadlines announced earlier are moot unless and until the injunction lifts.

- Stay watchful: The Fifth Circuit’s expedited appeal could produce another rapid turnabout.

Test Your CTA Knowledge

Questions

- What does FinCEN’s new Red Alert say about the CTA filing requirement?

- A) Filing is mandatory by January 13, 2025

- B) Reporting companies are not required to file but may do so voluntarily

- C) Only foreign-owned companies must file

- D) No changes were announced

- How does this latest injunction impact FinCEN’s extended deadlines?

- A) They remain legally enforceable

- B) They’ve been suspended as the injunction re-blocks CTA enforcement

- C) They only apply to certain nonprofits

- D) They automatically extend to April 2025

Answers

- 1. B) Reporting companies are not required to file but may do so voluntarily

- 2. B) They’ve been suspended as the injunction re-blocks CTA enforcement

Also See