Licensed Clinical Social Workers (LCSWs) play a pivotal role in California's healthcare landscape, offering essential therapeutic, counseling, and support services to countless individuals. Their contributions to addressing mental health challenges and providing crucial resources cannot be overstated. Recognizing this significance, California has provisions for LCSWs to form their own professional corporations. However, this process requires meticulous preparation, especially with the state's specific naming conventions and the 51% ownership rule. By understanding and adhering to these guidelines, LCSWs can not only establish a compliant corporation but also leverage numerous benefits, including tax advantages and avenues for professional growth. Consulting legal experts becomes indispensable in this journey, ensuring every step aligns with the state's regulations.

by Zach Javdan

September 12, 2023

Licensed Clinical Social Workers (LCSW) in California provide therapy, counseling, and support to individuals and groups, addressing issues like mental illness and trauma. They are vital in the healthcare system, promoting mental health and connecting patients with essential resources.

In California, forming a Professional Clinical Social Work Corporation allows LCSWs to operate within a legal entity that offers liability protection, separating personal assets from professional debts and obligations.

Incorporating a Clinical Social Work corporation in California offers several tangible benefits. Firstly, it provides a clear financial boundary between the corporation and its owners. This means that if the corporation wants to take out a loan or credit, the individual owners aren’t typically held personally responsible. This separation safeguards personal assets and provides a cushion against business-related financial risks.

From a taxation perspective, these corporations are advantageous. Shareholders, or the people who own parts of the company, can often reduce the amount they pay in self-employment taxes. Moreover, the profits or losses the corporation makes are passed directly to these shareholders. This structure avoids the pitfall of double taxation, where both the corporation and the individual would be taxed, leading to potential savings.

Additionally, being part of such a corporation allows shareholders to access benefits that might not be readily available to individual practitioners. This includes health benefits and retirement plans, which are not only financially beneficial but also contribute to the well-being and security of the shareholders.

Beyond immediate benefits, a Clinical Social Work corporation in California is structured for long-term growth and collaboration. It’s designed to foster teamwork among professionals and ensures there’s a plan in place for future transitions, like when a senior member retires. This forward-thinking approach ensures the corporation’s longevity, allowing social workers to have a sustained and impactful presence in their community.

Consider the following when forming a Clinical Social Work corporation in the State of California:

Consult with a California Attorney Before Forming Your LCSW Corporation

Taking shortcuts or seeking the least expensive route when incorporating can lead to challenges later on. It’s essential to understand the intricacies involved in setting up an LCSW corporation in California.

Detailed Navigation: From timing and formalities to understanding tax implications, every step in the incorporation process requires meticulous attention.

Potential Liabilities: LCSWs shoulder significant responsibilities in their profession. Being aware of potential exposures and how to mitigate them is crucial.

Expert Guidance: Incorporating isn’t just about paperwork; it’s about laying a strong foundation for your practice’s future. An attorney can provide the clarity and guidance needed to navigate this process effectively.

A Critical Note: LCSWs Cannot Form LLCs

One of the most common and costly mistakes made by Licensed Clinical Social Workers (LCSWs) is the formation of Limited Liability Companies (LLCs). It’s crucial to understand that in California, LCSWs are prohibited from forming LLCs for their practices.

The consequences of this oversight can be severe:

Legal Repercussions: Operating as an LLC when it’s prohibited can lead to legal penalties and potential disciplinary actions by licensing boards.

Financial Implications: LCSWs may find themselves facing unexpected tax liabilities or fines. Additionally, the costs associated with correcting the entity type, such as refiling fees and potential legal consultation, can be substantial.

Operational Challenges: Transitioning from an incorrectly formed LLC to the appropriate corporate structure can disrupt business operations, potentially affecting client relationships and service delivery.

It’s imperative to be informed and avoid this common pitfall. Ensure you’re setting up the right entity for your practice from the outset.

If you’re considering forming an LCSW corporation, call us anytime for a free attorney consultation at (310) 765-2525 or get the process started using or safe and secure online order option.

LCSW Corporation Ownership & Control

When forming a California LCSW Corporation, it’s paramount to ensure that all shareholders are qualified to own shares in the business.

Licensed Clinical Social Workers (LCSWs) looking to incorporate might think of inviting friends or family to invest in their practices as shareholders. However, there are specific regulations in place that dictate who can own shares in an LCSW Corporation.

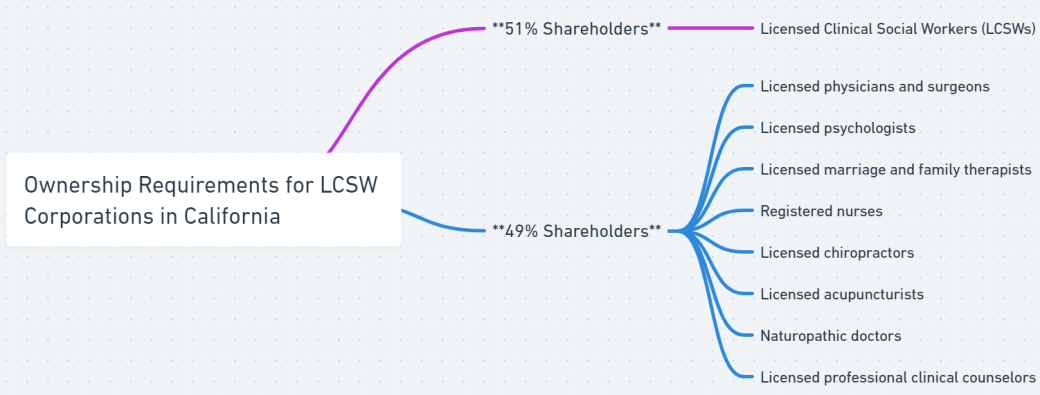

According to the California Corporations Code section 13401.5, at least 51% of the shareholders in an LCSW Corporation must be Licensed Clinical Social Workers.

For the remaining 49% of shareholders, they can be from the following licensed professions: (1) Licensed physicians and surgeons, (2) Licensed psychologists, (3) Licensed marriage and family therapists, (4) Registered nurses, (5) Licensed chiropractors, (6) Licensed acupuncturists, (7) Naturopathic doctors, or (8) Licensed professional clinical counselors.

This means that unless your friend or family member holds one of the above licenses, they cannot be a part owner of the California LCSW Corporation.

Ensuring that the ownership structure aligns with these requirements is not just a matter of compliance; it’s about maintaining the integrity and primary focus of the LCSW Corporation on providing professional clinical social work services.

The purpose of these rules are to ensure that the primary control and decision-making power of the corporation remains with those directly involved in the field of clinical social work. This structure preserves the core professional focus of the corporation while allowing for interdisciplinary collaboration.

If you’re considering establishing an LCSW Corporation, it’s always a wise move to consult with a California attorney familiar with these specific regulations to ensure you’re on the right track.

Why Every Multi-Owner LCSW Corporation Needs a Buy-Sell Agreement

In the dynamic world of business, especially within LCSW corporations, unexpected events can drastically alter the course of operations. Deaths, incapacitations, divorces, or disputes can lead to chaos, financial turmoil, and even the end of the corporation. This is where the Buy-Sell Agreement, often termed a “business will,” steps in as a crucial safety net, when your LCSW corporation has more than one owner.

A Buy-Sell Agreement is a binding contract between co-owners of a corporation. It meticulously outlines the terms under which an owner’s shares can be sold or transferred, acting as a prenuptial agreement for your business. This agreement provides clarity during crises, prevents unwanted ownership transfers, and sets fair pricing terms for shares.

Here are some hypothetical scenarios showcasing the risks of not having a shareholder buy-sell agreement:

Divorce Scenario: Without a Buy-Sell Agreement, a co-owner’s divorce could result in their ex-spouse claiming a portion of the corporation’s shares, disrupting harmony and decision-making.

Death Scenario: In the event of a co-owner’s sudden demise, their shares might inadvertently be passed on to someone unfamiliar with the LCSW profession, and that is not a qualified owner risking potential mismanagement and invalidation of the corporation.

Incapacity Scenario: If a co-owner becomes incapacitated, the agreement can dictate how their shares are managed or bought out, ensuring uninterrupted operation.

Disputes Scenario: In case of a disagreement between co-owners, the agreement can offer a mechanism for a buyout, preventing potential deadlocks or dissolution.

While online platforms might assist in establishing your LCSW Corporation, they often miss the nuances and significance of a tailored Buy-Sell Agreement. It’s more than just a template; it’s about future-proofing your corporation.

A Buy-Sell Agreement is a testament to the foresight and responsibility of LCSW corporation owners. It ensures the corporation’s resilience against unforeseen challenges. For the longevity and prosperity of your LCSW Corporation, this agreement is indispensable. Don’t gamble with your corporation’s future.

Determine Whether You Should Form a C or S Corporation for Your LCSW Practice

Navigating the world of corporations can be intricate, especially when deciding between a C Corporation and an S Corporation for your LCSW practice. Each has its unique advantages, tax implications, and considerations. Let’s delve into the differences, benefits, and factors to consider for each, ensuring you make an informed decision tailored to your professional needs.

A C Corporation, often simply termed a “C Corp,” is the standard corporation under the IRS code. Here’s what you need to know:

Taxation: C Corps face double taxation. First, the corporation itself pays taxes on its profits. Then, shareholders pay taxes on dividends they receive.

Ownership Flexibility: C Corps can have unlimited shareholders and multiple classes of stock, offering flexibility in raising capital and structuring ownership.

Benefits: C Corps can offer a broader range of benefits, like stock options and employee stock purchase plans, which can be attractive for retaining top talent.

Considerations: While C Corps offer flexibility in ownership and benefits, the double taxation aspect can be a significant drawback for some businesses.

An S Corporation, or “S Corp,” is a special designation that allows businesses to avoid double taxation. Here’s the breakdown:

Taxation: S Corps are pass-through entities. This means the corporation itself doesn’t pay federal taxes. Instead, profits and losses “pass through” to shareholders, who report them on their personal tax returns.

Ownership Restrictions: S Corps have limitations. They can’t have more than 100 shareholders, and all shareholders must be U.S. citizens or residents. Additionally, they can only have one class of stock.

Benefits: The primary advantage of an S Corp is the tax savings for you and your business. By avoiding double taxation, you might keep more of your hard-earned money.

Considerations: While the tax benefits are significant, the ownership restrictions can be limiting, especially for businesses looking to expand or attract diverse investors.

Your choice between a C Corp and an S Corp hinges on your long-term goals, tax strategy, and ownership preferences. Consider the following:

Tax Strategy: If minimizing taxes is a priority and you can work within the ownership constraints, an S Corp could be the way to go.

Ownership Structure: If you have a simple ownership structure and don’t anticipate that changing soon, an S Corp can offer significant tax advantages.

In the dynamic landscape of LCSW practices, ensuring your corporation aligns with your vision is paramount. It’s always a prudent move to consult with a tax advisor or attorney familiar with the nuances of LCSW practices to guide you in making the best decision for your unique situation.

Naming a California Professional Licensed Clinical Social Worker Corporation

Choosing a name for your Licensed Clinical Social Worker Corporation in California is not just about branding; it’s also about compliance. California has specific naming conventions for professional corporations, and LCSW corporations are no exception. Let’s explore the naming requirements as per the California Business and Professions Code.

According to the California Business and Professions Code Section 4998.2, the name of a licensed clinical social worker corporation must:

Contain the Words “Licensed Clinical Social Worker”: This ensures clarity about the nature of the professional services offered by the corporation.

Include Wording or Abbreviations Denoting Corporate Existence: Common abbreviations include “Corp.”, “Inc.”, “Ltd.”, and “PC” (Professional Corporation).

Avoid Misleading Names: The name should not be false, misleading, or deceptive. It should accurately represent the services the corporation provides.

Fictitious Business Names: If the LCSW corporation conducts business under a fictitious name, it must not use a name that is misleading. Furthermore, patients must be informed, prior to the commencement of treatment, that the business is conducted by a licensed clinical social worker corporation.

Name Availability: Before finalizing a name, it’s crucial to check with the California Secretary of State’s office to ensure the desired name is available and not already in use by another entity.

Compliance with naming conventions is not just a bureaucratic formality. It serves several essential purposes:

Public Clarity: It ensures that the public can easily identify the nature of services provided by the corporation.

Professional Integrity: Adhering to the conventions upholds the integrity and professionalism of the LCSW practice.

Legal Protection: Compliance helps avoid potential legal disputes related to name infringement or misrepresentation.

In conclusion, naming your LCSW corporation in California requires a blend of creativity, professionalism, and adherence to the state’s naming conventions. As always, when in doubt, consulting with a legal professional familiar with California’s LCSW regulations can provide clarity and confidence in your naming decision.

Determine Who the Agent of Service of Process Will be

When establishing a Licensed Clinical Social Worker Corporation in California, one of the pivotal decisions you’ll need to make is determining who will act as the Agent of Service of Process. This role, often overlooked in the excitement of starting a new venture, is crucial for the legal functioning of your corporation.

The Agent for Service of Process is an individual or business entity designated to receive legal documents on behalf of the corporation. These documents can include lawsuits, subpoenas, and other legal notices. Essentially, this agent acts as the corporation’s legal point of contact.

Here are some important things to consider:

Legal Requirement: In California, every corporation is mandated to have a registered agent. Without one, you cannot legally conduct business.

Timely Response: With an agent in place, your corporation can promptly address any legal actions, ensuring you don’t miss crucial deadlines.

Privacy: If a lawsuit is ever filed against your corporation, having an agent ensures that you won’t be served with legal papers in front of clients, staff, or in a public setting, which could harm your professional reputation.

Consistency: An agent provides a consistent point of contact, ensuring that important legal documents aren’t misplaced or overlooked.

Flexibility: If your business doesn’t operate during regular business hours, or if you’re often out of the office, an agent ensures that legal documents are still received.

When selecting an agent, consider the following:

Availability: The agent must be available during regular business hours to receive documents.

Reliability: Choose someone trustworthy who will promptly inform you of any received documents.

Location: The agent must have a physical address in California. P.O. boxes aren’t acceptable.

Longevity: Consider the long-term availability of the agent. If you think they might not be available in the future, it might be wise to choose someone else or hire a professional service.

Many corporations opt for professional registered agent services. These companies specialize in receiving and handling legal documents, ensuring compliance and timely responses.

The Agent for Service of Process plays a pivotal role in safeguarding your corporation’s legal interests. While it might seem like a minor administrative detail, the right agent can make a significant difference in how smoothly your corporation handles legal matters. As with all aspects of establishing your LCSW Corporation, thoughtful consideration and proactive decision-making are key.

File Articles of Incorporation

Embarking on the journey of establishing a Licensed Clinical Social Worker Corporation in California requires a series of legal steps. One of the most foundational of these steps is filing the Articles of Incorporation. This document, often seen as the birth certificate of your corporation, lays the groundwork for your business’s legal structure.

The Articles of Incorporation is a formal document that officially establishes the existence of your corporation in the eyes of the state. It provides the state with essential information about your business and sets the initial rules governing the management and operations of the corporation.

The following details are included in California Articles of Incorporation:

Corporate Name: Your corporation’s name must adhere to specific naming conventions, as referenced above.

Purpose of the Corporation: The Articles must specify that they are formed to provide licensed clinical social worker services.

Stock Information: Detail the number of shares the corporation is authorized to issue. If there are different classes of stock, specify the rights and limitations of each class.

Registered Agent: Identify the Agent for Service of Process, the individual or entity designated to receive legal documents on behalf of the corporation.

Principal Office Address: Provide the primary business address where the corporation will operate.

Incorporator’s Information: The incorporator is the individual responsible for executing the Articles of Incorporation. Their name, signature, and address must be included.

Once the Articles of Incorporation are drafted, they must be filed with the California Secretary of State’s office, along with the appropriate filing fee. After approval, the state will provide a filed copy of the Articles of Incorporation, officially marking the birth of your LCSW Corporation.

Filing the Articles of Incorporation is a significant step in the formation of your LCSW Corporation. It’s not just a bureaucratic requirement but a declaration of your business’s existence and intent. Ensure that the document is meticulously drafted, capturing all the necessary details, to set a solid foundation for your corporation’s future endeavors.

Prepare Organizational Corporate Minutes

The formation of a Licensed Clinical Social Worker Corporation in California is a meticulous process, and while filing the Articles of Incorporation is a significant step, it’s just the beginning. Once your corporation is officially recognized, it’s essential to document its initial activities and decisions. This is where organizational corporate minutes come into play.

Organizational corporate minutes are the written record of the initial decisions made by the corporation’s board of directors. These minutes serve as a formal record of actions taken during the first board meeting after the corporation’s formation.

Minutes are crucial for the following reasons:

Legal Compliance: Maintaining accurate and timely minutes is a legal requirement in California. It ensures transparency and accountability in the corporation’s operations.

Historical Record: Minutes provide a chronological record of the corporation’s decisions, offering insights into its evolution and growth.

Dispute Resolution: In case of disagreements or misunderstandings among shareholders or directors, minutes serve as a reference point, detailing what was agreed upon.

Decision Making: Future boards can refer to past minutes to understand the rationale behind previous decisions, aiding in informed decision-making.

Minutes should include the following:

Meeting Details: Specify the date, time, and location of the meeting. Mention whether it was a regular or special meeting and if it was held in person or virtually.

Attendees: List all directors present. If any directors were absent, note that as well.

Agenda Items: Clearly outline the topics discussed during the meeting. For an organizational meeting, this might include appointing officers, adopting bylaws, and issuing shares of stock.

Decisions Made: Document any resolutions passed or decisions made. This could involve approving the corporation’s bylaws, setting up a corporate bank account, or determining the corporation’s fiscal year.

Once prepared, corporate minutes should be reviewed for accuracy, approved by the board, and then stored safely. While they don’t need to be filed with any state agency, they should be readily accessible for future reference, audits, or legal proceedings.

Organizational corporate minutes are more than just a formality; they’re a testament to the corporation’s commitment to transparency, accountability, and good governance. As your LCSW Corporation takes its first steps, ensure that every decision is documented meticulously, setting a precedent for thoroughness and professionalism.

Prepare Bylaws for Your LCSW Corporation

The foundation of any corporation, including a Licensed Clinical Social Worker Corporation, is built upon its bylaws. These critical documents provide a roadmap for how the corporation will operate, offering clarity and structure to its internal management. Let’s delve into the importance of bylaws and the key details that should be included when drafting them.

Bylaws are the internal operating rules of a corporation. They outline the procedures for making decisions, the roles and responsibilities of officers and directors, and the rights and obligations of shareholders. While bylaws don’t need to be filed with the state, they are legally binding documents that the corporation must adhere to.

Legal Requirement: In California, every corporation is required to have bylaws. They provide evidence that the corporation is operating in compliance with state law and its own established procedures.

Operational Clarity: Bylaws offer a clear framework for decision-making processes, helping to prevent disputes and misunderstandings among shareholders, directors, and officers.

Protection: In case of legal challenges, bylaws can serve as evidence that the corporation has been operating properly and making decisions in accordance with its established procedures.

Bylaws for professional LCSW corporations should contain the following key components:

Professional Services: The bylaws should clearly state that the primary purpose of the corporation is to provide licensed clinical social work services. This emphasizes the specialized nature of the corporation and its commitment to professional standards.

Shareholder Qualifications: The bylaws should specify that shareholders must be licensed professionals, as defined by the California Business and Professions Code. This ensures that the corporation remains compliant with state regulations regarding ownership.

Management and Control: It’s essential to highlight that the corporation’s management and control will be in the hands of licensed clinical social workers or other licensed professionals permitted by the state.

Organizational Structure: Define the roles and responsibilities of officers, directors, and shareholders. Specify the powers and limitations of each position.

Meeting Procedures: Outline how often meetings will be held, how they will be conducted, and the requirements for quorums and voting.

Record Keeping: Detail the corporation’s record-keeping practices, including where records will be kept and who will have access to them.

Fiscal Year: Define the corporation’s fiscal year for financial and tax purposes.

While there are generic bylaw templates available, it’s crucial for an LCSW Corporation to tailor its bylaws to its unique needs and operations. Given the specialized nature of LCSW services, the bylaws should reflect the corporation’s specific mission, values, and professional standards.

Bylaws are more than just a bureaucratic requirement; they are the guiding principles of your LCSW Corporation. They ensure smooth operations, protect the rights of all involved, and provide a clear path forward in times of uncertainty. As you embark on this journey, take the time to craft bylaws that truly resonate with the ethos of your corporation, ensuring a strong foundation for future success.

Issuing Stock in a California LCSW Corporation: A Comprehensive Guide

When forming a Licensed Clinical Social Worker (LCSW) Corporation in California, the issuance of stock to shareholders is a pivotal step. It’s not just about denoting ownership; it’s about ensuring compliance with California’s stringent regulations for professional corporations.

Contributions: Shareholders typically contribute capital, assets, or services in exchange for shares in the corporation. The value of these contributions determines the number of shares each shareholder receives.

Rights: Shareholders have specific rights, including the right to vote on major corporate decisions, receive dividends, and access the corporation’s financial records. The specifics of these rights are often detailed in the corporation’s bylaws.

As previously mentioned, California has specific ownership regulations for LCSW corporations:

Majority Ownership: At least 51% of the shares must be owned by Licensed Clinical Social Workers.

Remaining Ownership: The other 49% can be owned by other licensed professionals as specified by the California Corporations Code section 13401.5, including physicians, psychologists, registered nurses, and others.

Given the unique nature of LCSW corporations, stock certificates must contain specific language restricting ownership:

Restriction Clause: The stock certificate should clearly state that ownership is restricted to those professionals outlined in California Corporations Code section 13401.5. This ensures that if the stock is ever transferred, it remains in the hands of qualified professionals.

Reference to the Code: The stock certificate should reference California Corporations Code section 13401.5 to provide clarity on the ownership restrictions.

Every stock certificate issued by an LCSW corporation should also include:

Corporation Name: Clearly state the name of the LCSW corporation.

Number of Shares: Detail both the number of shares authorized for issuance and the specific number of shares being issued with that certificate.

Shareholder Name: The name of the shareholder to whom the certificate is issued.

Date of Issuance: Clearly state the date the certificate was issued.

Signatures: The certificate should be signed by both the president and the secretary of the corporation. In most professional clinical social worker corporations, the president and secretary are the same person.

Many online incorporation services or generic templates might miss the specific requirements for LCSW corporations. Overlooking the special language requirement can lead to significant compliance issues down the road. It’s not just a formality; it’s a legal necessity.

Issuing stock in an LCSW corporation is a nuanced process that requires careful attention to detail and adherence to California’s specific regulations. It’s always advisable to consult with a legal expert familiar with LCSW corporations in California to ensure that every step of the process is handled correctly and compliantly.

The Stock Ledger in an LCSW Corporation

In the intricate world of corporate governance and compliance, the stock ledger stands as a sentinel, meticulously recording every transaction related to a corporation’s shares. For Licensed Clinical Social Worker (LCSW) Corporations in California, maintaining an accurate stock ledger is not just a best practice—it’s a necessity.

A stock ledger is a detailed record of all stock transactions within a corporation. It tracks:

Issuance of Shares: Every time the corporation issues shares, the ledger captures the details.

Transfers of Shares: If a shareholder sells or transfers their shares to another party, the ledger records it.

Redemption of Shares: If the corporation buys back or redeems shares, it’s noted in the ledger.

Corporate Memory: The stock ledger serves as the corporation’s memory, providing a historical record of all stock-related activities. This history is invaluable during audits, legal disputes, or when making informed decisions about the company’s future.

Legal Compliance: For LCSW Corporations, ensuring that at least 51% of shares are owned by Licensed Clinical Social Workers is crucial. The stock ledger helps verify this ownership structure, ensuring compliance with California regulations.

The stock ledger, while perhaps not the most glamorous part of corporate governance, is undeniably one of the most vital. For LCSW Corporations, it’s a tool that ensures compliance, provides clarity, and safeguards the rights of shareholders. As with all corporate documents, it’s always wise to consult with legal professionals to ensure the stock ledger meets all regulatory requirements and best practices.

Securing Your LCSW Corporation’s Identity: The Need for a Tax ID Number

In the realm of business operations, the Tax Identification Number (TIN) or Employer Identification Number (EIN) is akin to an individual’s Social Security Number. It’s a unique identifier, essential for various business activities and compliance. For Licensed Clinical Social Worker (LCSW) Corporations in California, obtaining a Tax ID is a foundational step post-incorporation.

A TIN or EIN is a nine-digit number assigned by the Internal Revenue Service (IRS) to businesses operating in the United States. It’s used to identify the business entity for tax purposes and is important for the following reasons:

Tax Reporting and Compliance: The primary purpose of the EIN is for tax reporting. Whether it’s filing corporate tax returns, employee withholdings, or other tax-related activities, the EIN is the identifier the IRS uses.

Banking and Finance: Opening a business bank account? The bank will ask for the corporation’s EIN. It’s also needed when applying for business loans or credit.

Employee Hiring: If the LCSW Corporation plans to hire employees, the EIN is necessary for payroll processing and reporting employee taxes.

Business Licenses and Permits: Many local and state licenses and permits require an EIN as part of the application process.

Vendor and Client Relationships: Some vendors or clients may request the corporation’s EIN for their records, especially if they’re issuing payments or handling other financial transactions with the corporation.

Obtaining an EIN is more than just a regulatory requirement—it’s a key that unlocks various operational doors for your LCSW Corporation. From tax compliance to financial operations, the EIN is a cornerstone of your corporation’s identity. Ensure you obtain it promptly post-incorporation and handle it with the care it warrants.

Opting for S Corporation Status: The Role of IRS Form 2553

For Licensed Clinical Social Worker (LCSW) Corporations in California, the decision to elect S Corporation status can offer significant tax advantages. The vehicle to make this election is the IRS Form 2553. Let’s delve into the intricacies of this form and its importance.

IRS Form 2553, titled “Election by a Small Business Corporation,” is the official document used by corporations to elect to be treated as an S Corporation for tax purposes. By filing this form, the corporation is opting to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes.

LCSW’s typically opt for S corporation status for the following reasons:

Tax Savings: One of the primary reasons corporations elect S Corporation status is to avoid double taxation. Unlike C Corporations, which pay corporate taxes and then shareholders pay taxes on dividends, S Corporations allow income and losses to flow through directly to shareholders’ personal tax returns.

Flexible Characterization of Income: Shareholders can be employees of the business and draw salaries. This can lead to potential savings on self-employment taxes.

Filing details:

Eligibility Criteria: Not all corporations can elect S Corporation status. There are specific criteria, such as having fewer than 100 shareholders and issuing only one class of stock.

Filing Deadline: To be treated as an S Corporation for the entire tax year, Form 2553 must be filed no more than two months and 15 days after the beginning of the tax year the election is to take effect.

Consenting Spouses: If a shareholder’s shares in the corporation are considered community property under state law, the spouse is deemed to be a shareholder for the purpose of the S Corporation election. In such cases, the spouse should sign the Form 2553 as a “consenting spouse” to validate the election.

Electing S Corporation status through IRS Form 2553 can offer significant tax benefits for LCSW Corporations. However, it’s crucial to understand the implications, eligibility criteria, and the importance of timely and accurate filing. Given the potential complexities, especially around community property interests, it’s always advisable to consult with a tax professional or attorney familiar with S Corporations to ensure all bases are covered.

File a Statement of Information for Your LCSW Corporation

Every corporation in California, including LCSW Corporations, is required to file a Statement of Information with the California Secretary of State. This document provides essential details about the corporation, ensuring transparency and compliance with state regulations.

Here are key details about the Statement of Information:

Filing Schedule: After the initial Statement of Information is filed, subsequent statements are due based on a statutory required 6-month filing window. This window is determined by the month of incorporation, registration, formation, or conversion of the entity. For instance, if your corporation was formed in January, your filing period would be from August to January.

Penalties: Failure to file the required Statement of Information may result in penalties assessed by the Franchise Tax Board and could lead to suspension or forfeiture of the corporation.

Updates: If there are any changes in the corporation’s information between statutory filing periods, an updated Statement of Information should be filed.

Online Filing: For faster service, the Statement of Information can be filed online at the California Secretary of State’s BizFile Online portal.

The Statement of Information is not just a bureaucratic requirement; it serves as a public record of key details about the corporation. This transparency helps build trust with clients, stakeholders, and the general public. Moreover, it ensures that the state has up-to-date information about the corporation, facilitating smoother interactions with regulatory bodies.

Given the importance of the Statement of Information and the potential penalties for non-compliance, it’s crucial to stay on top of filing deadlines. Consider setting reminders or working with a legal professional to ensure timely and accurate filings.

File a Limited Offering Exemption Notice: Safeguarding Your LCSW Corporation

When establishing an LCSW Corporation in California, it’s not just about the foundational documents like Articles of Incorporation or Bylaws. One often overlooked but crucial document is the Limited Offering Exemption Notice. This notice is vital for corporations that intend to offer or sell securities under specific exemptions provided by the California Corporations Code.

The Limited Offering Exemption Notice is a mandatory filing for corporations that conduct transactions under section 25102(f) of the California Corporations Code. This section provides an exemption for certain securities offerings, ensuring that corporations comply with state securities laws without undergoing the rigorous process of a full securities registration. They are important for the following reasons:

Compliance with State Laws: Filing this notice ensures that your LCSW Corporation remains compliant with California securities laws. Non-compliance can lead to penalties, fines, and potential legal challenges.

Transparency: It provides transparency to potential investors, ensuring they are aware of the nature of the securities being offered and the exemption under which they are being issued.

Avoiding Unintended Consequences: Without this notice, your corporation might inadvertently violate securities laws, leading to potential legal ramifications and undermining investor confidence.

Here are some key details to consider:

Electronic Filing: As of July 22, 2005, the Limited Offering Exemption Notice is required to be filed electronically, ensuring a streamlined process and quicker response times. However, there are provisions for claiming a hardship exception if electronic filing is not feasible for your corporation. More details on electronic filing and exceptions can be found here.

Associated Fees: Like most filings, there’s an associated fee for submitting the Limited Offering Exemption Notice. Ensure you’re aware of the current fee structure to avoid any surprises.

Timely Filing: It’s essential to file the notice in a timely manner, typically soon after the decision to offer securities under the 25102(f) exemption. Delayed filings can lead to complications and potential non-compliance issues.

While the Limited Offering Exemption Notice provides a pathway for corporations to offer securities without a full registration, it’s not a blanket approval. Ensure that your offerings genuinely qualify under the 25102(f) exemption and that you’re transparent with potential investors about the nature of the securities and the associated risks.

In conclusion, while the process of establishing an LCSW Corporation involves multiple steps and documents, it’s crucial not to overlook the Limited Offering Exemption Notice. This notice, while seemingly administrative, plays a pivotal role in ensuring your corporation’s compliance with state securities laws and provides a foundation of trust with potential investors.

Remember, when in doubt, always consult with a legal professional familiar with California’s corporate and securities laws to ensure your LCSW Corporation is on solid legal ground.

Opening a Bank Account for Your LCSW Corporation: A Step-by-Step Guide

Navigating the legal and administrative intricacies of establishing an LCSW Corporation is a commendable feat. However, once the foundational documents are in place and the corporation is legally recognized, one of the next pivotal steps is to open a dedicated bank account for your corporation. This isn’t just a matter of convenience—it’s a crucial step in maintaining the corporation’s financial integrity and ensuring clear financial records.

A dedicated bank account is important for the following reasons:

Financial Separation: It’s essential to keep personal and business finances separate. This distinction not only simplifies accounting and tax processes but also reinforces the legal separation between the corporation and its owners.

Professionalism: Having a dedicated business account enhances your corporation’s professionalism when dealing with clients, vendors, and other stakeholders.

Clear Financial Records: A separate account ensures that all business transactions are easily traceable, aiding in accurate bookkeeping and financial reporting.

Here are the steps that should be taken when opening the bank account:

Choose the Right Bank: Not all banks offer the same services or terms for business accounts. Research and select a bank that aligns with your corporation’s needs, considering factors like fees, accessibility, online banking features, and customer service.

Gather Necessary Documents: Before heading to the bank, ensure you have all required documents. Typically, banks will ask for are the Articles of Incorporation and EIN (Employer Identification Number.

Understand the Fee Structure: Familiarize yourself with any fees associated with the account, such as monthly maintenance fees, transaction fees, and minimum balance requirements.

Consider Additional Services: Many banks offer additional services for business accounts, such as merchant services, business credit cards, or loan facilities. Assess if these services align with your corporation’s current or future needs.

Open the Account: Once you’ve chosen a bank and gathered all necessary documents, visit the bank to open the account. Some banks may also offer online account opening for business accounts.

Set Up Online Banking: In today’s digital age, having online access to your corporation’s bank account is almost a necessity. Ensure you set up online banking, enabling easy monitoring of transactions, online bill payments, and other essential functions.

Regularly Review and Reconcile: Once the account is active, make it a practice to regularly review transactions and reconcile the bank statement with your corporation’s financial records. This practice ensures financial accuracy and timely detection of any discrepancies.

Opening a bank account for your LCSW Corporation is more than just a procedural step—it’s a commitment to financial diligence and transparency. By ensuring that your corporation’s finances are organized and easily traceable, you’re laying the groundwork for financial stability and future growth.

Remember, while the process might seem straightforward, always ensure that the bank account aligns with your corporation’s operational needs and long-term financial goals. If in doubt, consulting with a financial advisor or accountant can provide valuable insights tailored to your specific situation.

Securing a Local Business License for Your LCSW Corporation: A Comprehensive Guide

Embarking on the journey of establishing an LCSW Corporation involves navigating a myriad of legal and administrative requirements. One such essential step, often overlooked in the excitement of launching a new venture, is obtaining a local business license. This license is a testament to your corporation’s commitment to operating within the legal frameworks of your locality.

Local business licenses are crucial for the following reasons:

Legal Requirement: Most cities and counties mandate businesses, regardless of their size or industry, to have a valid business license. Operating without one can lead to penalties, fines, or even the shutdown of your business.

Credibility and Trust: Holding a local business license enhances your corporation’s credibility. Clients and partners often view licensed businesses as more trustworthy and professional.

Access to Benefits: Some localities offer benefits, resources, or support to licensed businesses, such as training, networking events, or grants.

Revenue Tracking: Local governments use business licenses to track revenue for tax purposes, ensuring that businesses pay their fair share of local taxes.

Here are the steps you need to take when obtaining a business license for your clinical social worker corporation:

Research Local Requirements: Licensing requirements can vary significantly from one locality to another. Start by visiting the official website of your city or county’s business licensing department. Some areas might have specific requirements for professional services like LCSW Corporations.

Gather Necessary Documentation: Depending on your locality, you might need to provide proof of business address, EIN and state business registration.:

Complete the Application: Fill out the business license application form provided by your local government. Some cities offer online application processes, while others might require a paper submission. Nowadays, most of them are online.

Pay the Fee: There’s typically a fee associated with obtaining a business license. This fee can vary based on the size of your business, its location, or the nature of services you provide.

Undergo Inspections (if required): Some localities might require your business premises to undergo specific inspections (like fire safety or health inspections) before granting a license.

Receive Your License: Once approved, you’ll receive your business license. Display it prominently at your place of business, as many local regulations require it.

Stay Updated: Business licenses are not a one-time requirement. They often have expiration dates and need to be renewed periodically. Ensure you’re aware of the renewal process and timelines.

Obtaining a local business license is a testament to your LCSW Corporation’s commitment to operating ethically and within the bounds of local regulations. While it might seem like a mere administrative step, it plays a pivotal role in establishing your corporation’s legitimacy in the eyes of clients, partners, and the community at large.

Always stay updated with local regulations, as they can change. If you’re ever uncertain about the requirements or the process, consider reaching out to local business associations or consulting with a local attorney familiar with business licensing in your area.

Upholding the Integrity of Your LCSW Corporation: The Imperative of Maintaining Formalities

In the realm of establishing and operating an LCSW Corporation, the initial setup is just the beginning. The true test of a corporation’s resilience and legitimacy lies in its commitment to maintaining the required formalities and adhering to regulations consistently. This ongoing diligence not only ensures legal compliance but also fortifies the corporation’s reputation and operational stability.

Maintaining formalities is crucial for the following reasons:

Legal Protection: One of the primary reasons businesses opt for a corporate structure is the legal protection it offers to its owners. However, this protection can be jeopardized if the corporation fails to observe the necessary formalities, potentially exposing shareholders to personal liability.

Operational Continuity: Regular compliance checks and adherence to formalities ensure that the corporation operates without interruptions. It helps in avoiding unforeseen regulatory roadblocks or legal challenges.

Reputation Management: Consistent compliance with required formalities enhances the corporation’s credibility in the eyes of clients, vendors, financial institutions, and other stakeholders.

Financial Health: Proper maintenance of financial records, timely tax filings, and adherence to financial regulations safeguard the corporation’s financial health and facilitate informed decision-making.

Regulatory Compliance: For LCSW Corporations, there might be industry-specific regulations and standards to adhere to. Maintaining these standards is paramount to ensure the corporation’s license and operational legitimacy remain intact.

Here are some key formalities to adhere to:

Regular Board Meetings: Hold regular board of directors meetings, ensuring that minutes are taken and stored securely. This demonstrates the active governance of the corporation.

Annual Shareholder Meetings: Conduct annual meetings with shareholders, discussing key developments, financial health, and future strategies.

Financial Record Keeping: Maintain meticulous financial records, ensuring they are accurate and up-to-date. This aids in tax filings and financial audits.

Renew Licenses and Permits: Ensure that all professional licenses, business permits, and other necessary certifications are renewed timely.

File Annual Reports: Submit annual reports as required by the state.

Update Corporate Documents: Regularly review and update corporate documents like bylaws, shareholder agreements, and others to reflect any changes or developments.

Segregate Finances: Maintain a clear distinction between the corporation’s finances and personal finances of shareholders. This reinforces the separate legal entity status of the corporation.

Stay Abreast of Regulatory Changes: The legal and regulatory landscape can evolve. It’s essential to stay updated on any changes and ensure the corporation adapts accordingly.

The journey of an LCSW Corporation is not a one-time sprint but a continuous marathon. The commitment to maintaining formalities and ensuring compliance is a testament to the corporation’s dedication to excellence, integrity, and professionalism. By upholding these standards, the corporation not only safeguards its legal status but also paves the way for sustained growth and success in its endeavors.

Charting Your LCSW Corporate Future: Next Steps

Embarking on the journey of establishing an LCSW Corporation in California is a commendable endeavor. It not only showcases your commitment to providing top-tier clinical social work services but also demonstrates your foresight in ensuring the legal and financial well-being of your practice.

However, the intricacies of the incorporation process, combined with the unique requirements for LCSW Corporations, can be daunting. Missing a single step or overlooking a specific regulation can lead to complications down the road.

That’s where we come in. At LawInc, our mission is to guide you through every phase of your LCSW Corporation’s formation, ensuring compliance, clarity, and confidence.

Don’t leave your corporate future to chance. Take the next step with confidence.