by Sheren Javdan

December 1, 2014

There is always some risk involved with supporting the latest crowdfunding project and Indiegogo has finally found a way to offer its investors some accountability and assurances that their investment is safe.

Many projects are completed much later than anticipated or worse, they fail. Sometimes, the products just do not work. The Smarty Ring recently raised almost $300,000 and users are complaining that it barely works!

Sometimes, the projects on Indiegogo or Kickstarter are straight up jokes. Just recently a Kickstarter campaign started for “NoPhone” raised over $18,000. What does it do you ask? Nothing. It is literally a black chunk of plastic in the shape of a cellphone.

Although many investors understand the risks involved in funding a project (investors do not receive any equity in the company and in many cases they do not receive the actual product either), there still seems to be a craze in the crowdfunding market.

Indiegogo receives a lot of heat for being less restrictive than Kickstarter. Because there is no application process, they are completely lax with who can start a campaign and anyone can campaign. The company also allows campaigners to collect the total amount of money they raised regardless of whether or not their goal was reached. All leading to consumer hesitancy.

Indiegogo receives a lot of slack for being too easy to join with little restrictions.

Recently, Indiegogo created a consumer survey that measured consumers’ trust in both the site itself and its campaigners. When visiting the site, a little pop-up appears in the corner of your browser that asks a series of questions including what you find important in your crowdfunding site and what other sites you have used in the past.

Indiegogo users are prompted with a survey that measures their trust in the company

Trial Insurance

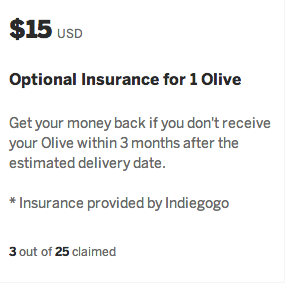

As a result of the consumer mistrust and fickleness of Indiegogo, they have responded with a trial optional insurance plan that allows users to purchase insurance.

Indiegogo implemented a trial insurance plan that provides users with security

Currently, they are testing the waters with their Olive stress management wristband. For an additional fee of $15, users purchase security in knowing that if the project is not delivered within 3 months of the estimated delivery date, they will get their investment back.

There are some catches, however. First, the insurance is limited to the first 25 people (there are currently 3) to claim the offer. In addition, if a project is delivered within the 3 month window but does not meet its users expectations, they are not insured.

In addition, there are some cases where the product is actually delivered in the 3 month window but does not work or is poorly crafted. In those situations, the user is not protected by the insurance.

Recently raising $40 million in funding, Indiegogo is exploring many different options in addition to the insurance policy. The Forever Funding program launched in September allows projects campaigners to continue raising money after the general 1 month time period. This provides users with an opportunity to better relate with the product and helps boost the products web traffic and SEO.

Topics: Indiegogo, Insurance, Kickstarter, Small Business, Startups