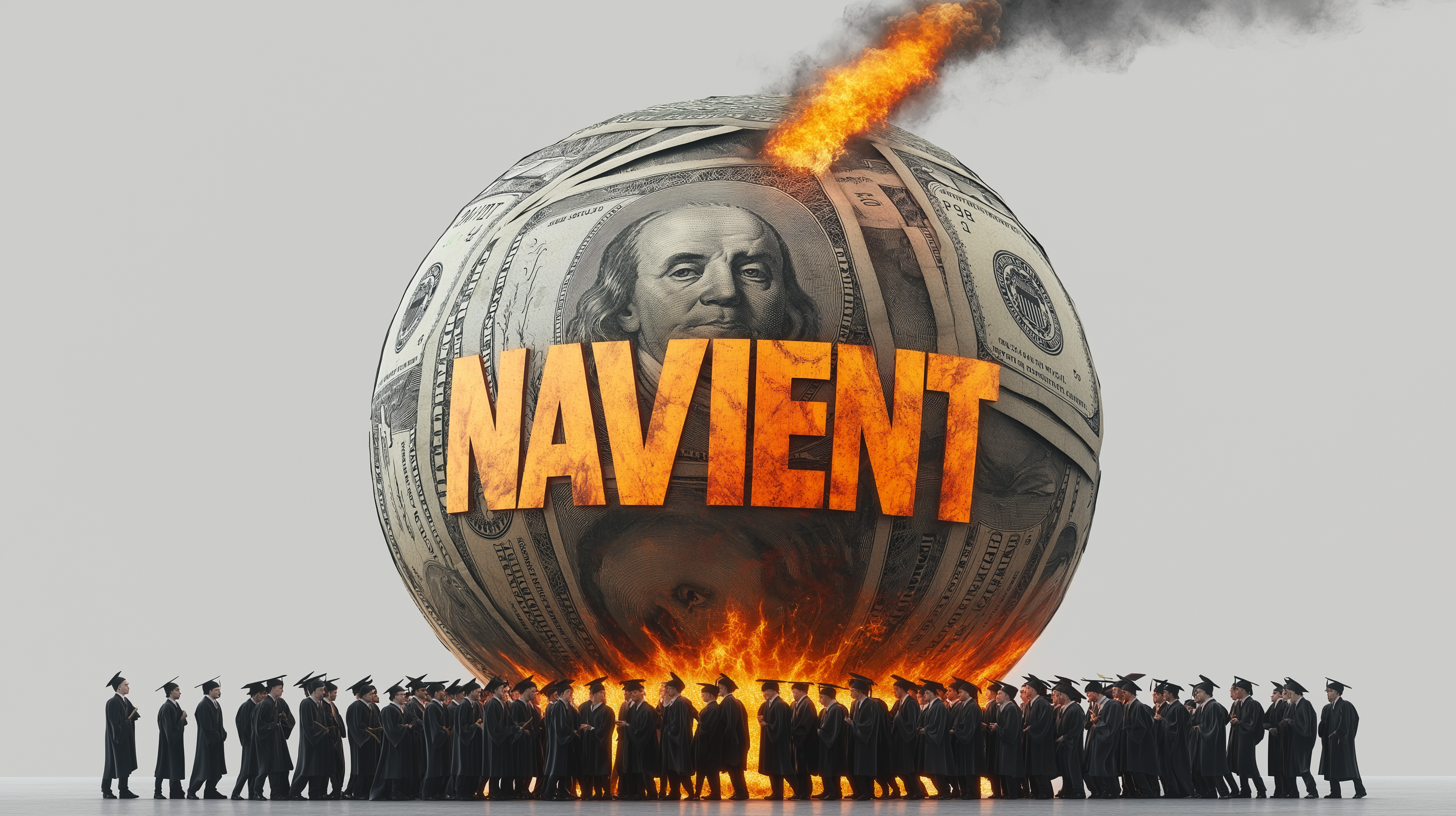

Navient's $120 million settlement exposes systemic failures in student loan servicing, impacting millions of borrowers. Understand your rights, review your loan history, and take action to protect yourself from predatory practices in the wake of this landmark case.

by LawInc Staff

September 15, 2024

Navient, one of the nation’s largest student loan servicers, reached a $120 million settlement to resolve Consumer Financial Protection Bureau (CFPB) allegations of misconduct and consumer deception. The deal marks a major victory for student borrowers who were misled by Navient on repayment options and driven deeper into debt.

This guide covers everything you need to know about the Navient settlement, the CFPB’s accusations, consumer remedies, how the case unfolded and its implications going forward. Get clarity on this complex litigation and what it means for students saddled with loan servicing woes.

From Navient’s alleged schemes to steer distressed borrowers into costly forbearances to its failures in advising on income-driven repayment plans, learn how one company’s practices wreaked financial havoc – and how regulators are fighting back.

1. Understand the CFPB’s Allegations Against Navient

-

- Unfair and Deceptive Practices: Navient systematically pushed borrowers into forbearance instead of counseling them on more affordable income-driven repayment (IDR) plans.

- Misallocating Payments: Navient misapplied or misallocated student loan payments, often miscounting them for consecutive billing cycles even after complaints.

- Misreporting to Credit Bureaus: Disabled borrowers, including injured veterans, had loans inaccurately reported in default after actually being forgiven.

- Deceiving Borrowers on Cosigner Releases: Navient misled borrowers about criteria to release cosigners from their private student loans.

- Falsely Certifying Loans for Forgiveness: Navient subsidiary Pioneer Credit overstated amounts forgiven under federal loan rehabilitation programs.

Examples:

-

- Michelle requested IDR but Navient put her in forbearance, giving a $28,000 bill that could have been much less with proper guidance.

- Navient told disabled Iraq vet John his $98,000 loan was in default when it had actually been discharged due to his injuries.

- Despite making 8 straight $300 payments, Amy’s balance stayed the same as Navient improperly allocated them across multiple loans.

- Navient falsely said Tina would get credit for all 12 rehab payments when fees would still be owed after 9 payments.

- Luis made consistent 12 on-time payments to release his cosigner per Navient’s policy, but was denied for paying ahead early.

The Allegations’ Significance

-

- As the largest U.S. student loan servicer, Navient’s alleged misconduct impacted millions of borrowers struggling with debt.

- Putting profits over borrowers, Navient cut corners to minimize costs, deceive consumers and deny access to payment relief.

- Improper credit reporting and certification failures worsened financial distress and undermined key loan forgiveness programs.

- The scope of harm underscores the high stakes for borrowers and the need for strong oversight of loan servicers.

- Navient’s alleged deception and unfairness represent some of the most serious allegations brought under federal consumer protection laws.

Key Laws At Issue:

-

- Consumer Financial Protection Act (CFPA): Prohibits unfair, deceptive or abusive acts and practices by student loan servicers.

- Fair Credit Reporting Act (FCRA): Requires accurate credit reporting and prompt correction of errors by information providers.

- Fair Debt Collection Practices Act (FDCPA): Bans false, deceptive or misleading representations in collecting student debts.

- Reg V: Obliges servicers to maintain reasonable procedures to provide accurate info when furnishing to credit bureaus.

- State UDAP Laws: Many states also sued Navient under their own unfair and deceptive practices statutes.

2. Navient’s History of Loan Servicing Failures

-

- Sallie Mae Spinoff: Navient was created in 2014 when Sallie Mae split its loaning and servicing operations.

- Structural Incentives to Cut Costs: As a servicing-only company, Navient sought to minimize expenses like advising borrowers.

- Compensation Driving Bad Conduct: Employee bonuses incentivized rushing borrower calls over exploring all options.

- Past Regulatory Actions: Navient previously paid millions for overcharging servicemembers and misallocating payments.

- Ongoing State Lawsuits: Several state AGs also sued Navient, leading to additional settlements for similar servicing breakdowns.

Examples:

-

- In 2014, the FDIC and DOJ reached a $97 million settlement with Navient. $60 million was designated for restitution to approximately 60,000 military members who were illegally overcharged on their student loans. The remaining $37 million settled claims of deceptive lending practices.

- The Dept of Education found Navient returned $22M in 2021 for wrongfully seizing borrowers’ tax refunds and wages.

- 39 states reached a $1.85B settlement with Navient in 2022 for originating predatory subprime private loans.

- From 2017-2019, the CFPB received 10,057 federal student loan complaints against Navient, 3x more than any other servicer.

- Navient call center reps had to hit a 7 minute average call time target to get bonuses, rushed borrower conversations.

Systemic Deficiencies

-

- Navient’s conduct reflects structural problems in the student loan servicing market putting profits ahead of borrowers.

- Misaligned incentives, weak oversight and lack of competition fostered an environment ripe for consumer abuse.

- Federal student loan programs’ complexity enabled servicers to exploit borrower confusion rather than counsel and assist.

- The repeat nature of Navient’s violations across multiple aspects of servicing shows its failures were systemic, not one-offs.

- Leadership focused more on earnings targets than keeping servicer practices and personnel focused on proper repayment guidance.

Servicing Market Dynamics:

-

- Borrowers Can’t Choose Servicers: Students have no control over which company handles their loans, limiting market discipline.

- No Price Competition: Borrowers don’t pay servicers directly so there’s little financial incentive to provide quality service.

- Lack of Switching: There’s no easy way for dissatisfied borrowers to take their business elsewhere if service is poor.

- Mismatched Interests: Servicer fees come from the govt, not borrowers, so loyalties lie with the govt contracts not customers.

- Regulatory Gaps: Servicers fall in a grey area between banking, debt collection and education regulations, enabling substandard practices.

3. Borrower Remedies Under the Settlement

-

- $120 Million Restitution Fund: Designated for borrowers harmed by Navient’s misconduct.

- Automatic Checks Sent: Impacted borrowers will receive payments without filing claims.

- Broad Coverage: Redress pool covers borrowers steered into forbearance, misled on IDR, and with misapplied payments.

- Injunctive Relief: Navient also required to reform practices and stop unfair and deceptive conduct going forward.

- Independent Oversight: Settlement compliance will be monitored by the CFPB to ensure lasting changes.

Examples:

-

- Karen will receive a check for $1,250 as compensation for Navient falsely telling her forbearance was her only hardship option.

- Dave, disabled after a car crash, gets $875 for Navient misreporting his discharged loan as in default.

- Borrowers who’d prepaid but had those payments misallocated by Navient will be sent settlement checks ranging from $250-$500.

- The deal requires Navient to tell borrowers about all repayment options and properly process payments to comply with servicing laws.

- CFPB auditors will review Navient’s call scripts, training, systems and complaint data to verify adherence to the agreement.

Accessing Relief

-

- Impacted borrowers don’t need to take action – the CFPB will use Navient’s records to identify those owed restitution.

- Settlement checks will be mailed to eligible recipients at their last known address so no claim forms are required.

- If borrowers have moved, they should update their address with Navient and the USPS to ensure they receive their checks.

- The settlement website will have a feature to look up payment eligibility for those unsure if they’re covered.

- Borrowers should be wary of scammers claiming they need to pay a fee or provide sensitive info to get their settlement money.

Other Impacts:

-

- Credit Reporting Corrections: Navient will update the credit reports of disabled borrowers it wrongly marked in default.

- Tax Implications: Settlement checks likely won’t be taxable as income but may be if loans were used for ineligible expenses.

- Underlying Loans Unaffected: The deal provides cash payments but doesn’t directly alter borrowers’ outstanding loan balances or terms.

- Combo with Loan Forgiveness: Borrowers may still be eligible for recently-announced federal student debt cancellation along with these funds.

- Increased Oversight: The CFPB will closely monitor Navient and other servicers to identify and stop new consumer harm.

4. Navigating the Student Loan Servicing System

-

- Understand Your Repayment Options: IDR plans can substantially lower payments and provide loan forgiveness.

- Don’t Rely on Servicer Advice Alone: Research alternatives and insist on a full explanation of choices, not the easiest solution for them.

- Get It In Writing: Hard copies of servicer communications help protect you if problems arise later.

- Keep Records and Contact Logs: Retain payment receipts, letters and call notes detailing what the servicer told you.

- File Complaints: Notify servicers, the CFPB, Dept of Ed and state officials of improper practices to trigger action.

Examples:

-

- Rather than accept Navient’s steer into forbearance, Jay asked about IDR and now pays $75/mo instead of $350 with REPAYE.

- Amber consulted the Dept of Ed’s Loan Simulator tool to compare options, not just relying on her servicer’s phone rep.

- Jamal saved emails advising him to file an IDR renewal app by 8/15 to protect against the servicer later claiming no notice.

- Liz kept meticulous notes of her servicer calls, noting the rep’s name, date and details discussed in case issues emerged.

- When his servicer wrongly said his loans weren’t eligible for PSLF, Tom filed CFPB and state AG complaints, prompting a correction.

Reform Initiatives

-

- The Dept of Ed is revamping loan servicer contracts and performance standards to prioritize borrower success metrics.

- Policymakers propose replacing servicers with a single repayment portal to standardize processes and advice.

- State laws to fill federal regulatory gaps, like requiring servicer licenses and minimum operating standards, are rising.

- Increased oversight like regular CFPB exams and audits aims to quickly identify compliance violations and risks to borrowers.

- DoE is automating data-sharing with servicers to facilitate enrollment in IDR plans and catching payment misapplications.

Policy Debates:

-

- Servicer Accountability: What’s the right balance of standards, oversight and penalties to ensure servicers act lawfully?

- Borrower Responsibility: Do distressed borrowers have any duty to seek out info on options or is servicer guidance enough?

- Federal Loan Complexity: Has the growth of repayment and forgiveness plans contributed to servicer difficulty providing good guidance?

- Servicing Capacity: With PSLF, IDR and other programs rising, do servicers have the staffing and systems to administer them?

- Loan Forgiveness: Will broad federal debt cancellation reduce harm from subpar servicing or create new implementation issues?

5. Evaluting the Settlement’s Significance

-

- Groundbreaking Consumer Redress: The $120M payout is among the CFPB’s top 5 resolutions and its largest for student loans.

- First Major Case Resolved: Concludes the CFPB’s landmark 2017 lawsuit and paves the way for other servicer accountability.

- Validation for Borrowers: Acknowledges many borrower experiences and complaints about servicer misconduct as legitimate and compensable.

- Signals Increased Oversight: Shows Biden Administration priority on stronger consumer financial protection enforcement.

- Blueprint for Reform: Settlement terms provide a roadmap for servicing practices that other market participants should adopt.

Examples:

-

- The DoE said Navient’s steer of 1.2M borrowers into forbearance who enrolled in IDR within 12 months underscored need for redress.

- CFPB Director Chopra pledged to work with DoE and states to end “illegal servicing schemes” and return money to harmed borrowers.

- One borrower said “I feel seen” by the deal validating years of stress with Navient rejecting her IDR and PSLF paperwork.

- The CFPB’s related settled suits with servicers Discover Bank and EdFinancial show a broader crackdown beyond just Navient.

- Navient competitors are rapidly reviewing policies on IDR, forbearances, payment processing and specialist training to avoid scrutiny.

Looking Ahead

-

- The settlement’s long-term impact depends on sustaining the oversight and reforms it kickstarted beyond this one case.

- With 45M borrowers and $1.6T in loans, the student debt market needs a modernized, borrower-centric servicing system at scale.

- Structural reforms should align servicer incentives with borrower success so violations aren’t profitable in the first place.

- Borrowers need accessible, actionable information to make informed decisions, not just disclosures of unclear repayment options.

- Robust enforcement must combine public and private actions, as consumer complaints and state AGs also drove progress here.

The Big Picture:

-

- Loan Servicing: The Navient case exposed deep-rooted flaws in student loan servicing, an often overlooked but critical function.

- Borrower Burdens: Holding servicers accountable is key as borrowers bear the costs of a complex lending and repayment system.

- Consumer Protection: Active oversight of loan servicers is an important part of the CFPB’s mission to protect families’ financial futures.

- Shared Responsibility: The student loan crisis needs a combination of servicer reforms, college cost controls and balanced borrower relief.

- Systemic Risk: Absent change, servicing failures could impair borrowers’ financial health and expose them to long-term consequences.

Key Takeaways

Student loan servicer Navient will pay $120 million in restitution to borrowers and reform its practices to settle CFPB claims it misled and overcharged consumers at every stage of repayment.

The Navient settlement is a major victory for student loan borrowers, resolving claims of widespread unfair and deceptive practices that cost consumers $120 million and underscoring the need for stronger oversight across the servicing industry to prevent future harm.

While the deal provides important relief and validation for those impacted, it also reveals structural problems in the student lending market that enabled Navient’s conduct in the first place, from complex repayment options to misaligned servicer incentives.

For borrowers navigating the system, the case is a reminder to fully understand their options, get key information in writing, keep detailed records and not rely on servicers alone for guidance.

But the settlement should also accelerate reforms to make loan servicing more transparent and accountable through a combination of borrower-centric policies, advanced data systems and robust enforcement to protect consumers.

Absent sustained change, the student debt crisis will only deepen the financial distress facing many of the 45 million Americans who sought an education but are now burdened by a lending and repayment process stacked against them. The Navient settlement charts a path forward if its lessons and oversight endure.

I Have a Navient Student Loan – What Should I Do?

If you have a federal student loan serviced by Navient and believe you may have been impacted by the conduct described in the CFPB’s lawsuit and settlement, here are some key steps:

If you’ve experienced problems with your Navient student loans, submit a complaint to the CFPB to voice your concerns and seek assistance.

-

- 1. Review Your Account: Request a full payment history from Navient and audit it for any potential misapplied payments, unexplained fees, improper default/delinquency reporting or forbearances you didn’t request.

- 2. Check for IDR Eligibility: Use the DoE’s Loan Simulator at studentaid.gov to see if you might qualify for a lower payment under an income-driven repayment plan and if so, apply directly there, not through Navient.

- 3. Verify Navient Updates: The settlement requires Navient to notify borrowers of updated procedures to process IDR apps and payments – make sure you receive and read this info and confirm it matches your experiences.

- 4. Assert Your Rights: If you encounter ongoing servicing issues with Navient, file complaints with the CFPB, DoE and your state AG, noting that repeat violations may breach the settlement terms.

- 5. Watch for Your Check: If you are due restitution under the settlement based on Navient’s records, you should receive a check in the coming months without needing to file a claim. Notify the CFPB if you think you were missed.

- 6. Consider Consolidation: Borrowers with multiple loans or servicers may want to explore a federal Direct Consolidation Loan to simplify repayment under a single servicer and gain access to certain IDR and PSLF options.

- 7. Stay Informed: Monitor the CFPB and DoE websites, sign up for email updates and watch for notices from Navient about further developments in implementing the settlement remedies and reforms.

Remember, you have rights and protections as a borrower. Don’t hesitate to ask questions, raise concerns and file complaints if you encounter servicing problems. Navient’s settlement shows that borrowers can fight back and get results.

While the servicing system still has room for improvement, this deal is a meaningful step towards holding companies accountable and making the repayment process work better for the millions of Americans who took out loans in good faith to gain an education.

So stay engaged, understand your options and don’t be afraid to speak up. As a student loan borrower, you deserve accurate information, fair treatment and a repayment system that helps you succeed, not one that sets you up to fail.

Disclaimer

This article is for general informational purposes only and is not intended as legal advice regarding any individual’s specific student loans or Navient accounts. Borrowers should consult the CFPB, Dept of Education and a qualified attorney about their rights and options under the settlement and servicing laws.

While the information is presented in good faith and believed to be accurate, it may include errors or inaccuracies. Borrowers are responsible for doing their own verification and analysis before making financial decisions. The author expressly disclaims any liability arising from use of this material.

As ongoing developments emerge in the Navient settlement, student loan servicing reform and borrower relief efforts, certain information may change or require updating. However, the core advice for borrowers to know their rights, stay informed and take action to address servicing issues remains evergreen.

Further Reading and References

- 2017 CFPB Press Release

- 2017 CFPB Complaint Against Navient

- 2024 CFPB Proposed Navient Settlement

- 2024 CFPB Press Release on Navient Settlement

- Prepared Remarks of CFPB Director Rohit Chopra on the Navient Enforcement Action Press Call

- Federal Student Aid Loan Simulator

- National Consumer Law Center Student Loan Borrower Assistance Project

Need Legal Help?

If you need legal assistance, in any field of law, our free concierge service can connect you with experienced attorneys in any practice area and state. Contact us to learn more.

Also See

Oracle’s $115M Privacy Bombshell: How to Claim Your Share of the Historic Settlement