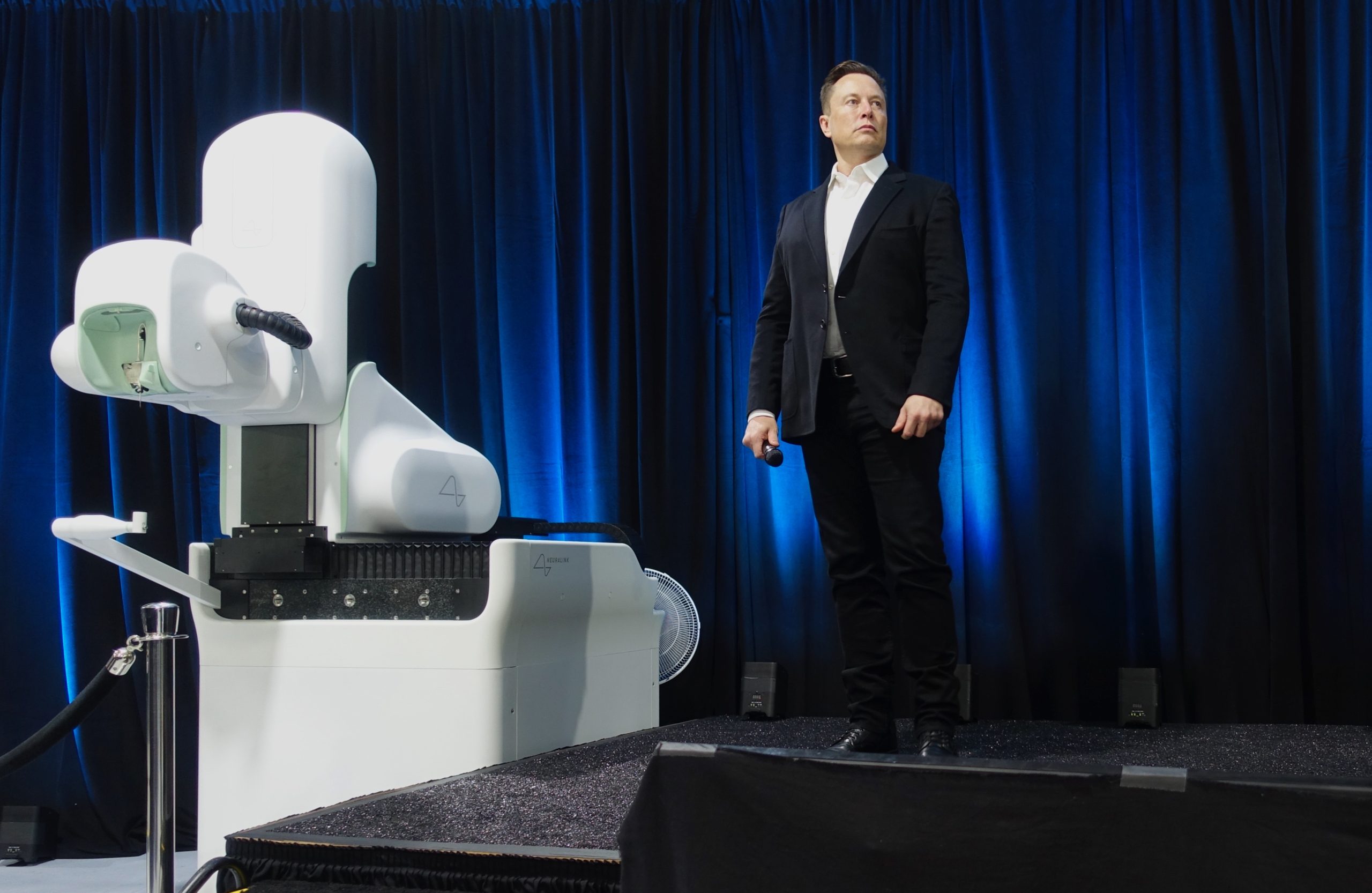

Elon Musk's hypothetical FutureX merger faces a complex web of antitrust scrutiny and corporate governance challenges. Unifying Tesla, SpaceX, Twitter/X, and more under one corporate umbrella would require navigating intricate legal hurdles while balancing innovation with regulatory compliance. Elon Musk photo credit Steve Jurvetson.

by LawInc Staff

July 25, 2024

In a recent tweet, TED head Chris Anderson made a bold suggestion to Elon Musk: consolidate all of his various companies (Tesla, SpaceX, Twitter/X, Neuralink, Boring Co.) into a single mega-corporation called “FutureX”. Anderson argued this restructuring would reduce conflicts of interest, enable greater synergies, and align all the ventures under an audacious mission to build a future worth being excited about.

Despite my disagreements with some of @ElonMusk’s political posturing, I still regard him as a truly remarkable entrepreneur. Someone capable of shaping the future perhaps more than any one else on the planet. But right now I believe he’s in danger of juggling too many balls in… pic.twitter.com/pXMJtKrePU

— Chris Anderson (@TEDchris) July 24, 2024

But would such a massive corporate consolidation actually be feasible from a legal perspective? What regulatory hurdles and potential pitfalls would Musk face in attempting this? This overview walks through everything you need to know about the laws, precedents, benefits, risks, and practical considerations surrounding a hypothetical FutureX merger.

From antitrust implications to shareholder rights, tax strategies, brand impacts and more, get an in-depth look at this thought-provoking idea from all angles.

1. Understand the Potential Legal Benefits

-

- Reduced Conflicts of Interest: Housing Musk’s companies under one entity could mitigate legal risks from him wearing too many hats.

- Streamlined Regulatory Compliance: A unified company may have an easier time navigating industry-specific laws and reporting requirements.

- Shared Resources & Talent: Consolidation would allow greater sharing of assets, IP, expertise between ventures with less red tape.

- Tax Efficiencies: Restructuring may open doors for tax optimization strategies across domestic and international operations.

- Flexibility in Financing: Combined balance sheet could enable better debt/equity

structures and terms.

Examples:

-

- Housing Tesla’s self-driving tech, SpaceX’s rockets, Neuralink’s brain-computer interfaces under one roof may raise less eyebrows than Musk splitting time between them as distinct entities.

- FutureX could have a unified legal & compliance department ensuring each division meets applicable laws – FAA for SpaceX, state DMVs for Tesla, etc.

- Boring Co. could utilize SpaceX’s advanced materials and Tesla batteries without extensive contracting or IP sharing agreements between separate companies.

- Losses in one division may be written off against gains in other more profitable ones to reduce overall corporate tax burden in a given year.

- Twitter/X’s cash flow merged with SpaceX and Tesla’s assets could help FutureX secure better financing to fund ambitious new ventures.

How It Could Work:

-

- Structure FutureX as a holding company that wholly owns Tesla, SpaceX, Twitter/X, Boring, Neuralink as subsidiaries. Each operates independently but under central management.

- Devise a clear conflict of interest policy laying out what decisions Musk can be involved in for each division to maintain separation as needed.

- Integrate legal/compliance teams to harmonize policies, monitor regulatory changes, ensure consistent adherence to industry-specific requirements.

- Strategically locate parts of the business in tax-advantaged jurisdictions and utilize transfer pricing between subsidiaries to optimize tax exposure.

- Conduct a substantive financial and legal audit to identify opportunities to leverage the combined entities’ assets and cash flows for better capital access.

Key Considerations:

-

- Could FutureX still bid on government contracts with Musk’s companies under one umbrella? Likely yes, with robust internal controls and conflict of interest policies to prevent unfair advantages.

- Would Musk be able to maintain the same degree of ownership control? Potentially, by using a dual-class share structure with special super-voting shares for himself.

- How might a merger impact each venture’s unique culture and identity? Careful change management and maintaining distinct sub-brands under the FutureX parent could ease the transition.

- What legal challenges might arise from folding a public company (Tesla) together with private ones? Engaging experienced securities counsel to navigate the disclosure and regulatory requirements would be critical.

- Would there be pushback from employees with equity/options in the individual companies? Providing the opportunity to swap into FutureX shares/options and communicating the upside could build buy-in.

2. Consider the Antitrust & Competition Law Hurdles

-

- Mergers & Acquisitions Regulation: Musk would need regulatory approvals from the likes of the FTC, DOJ, SEC for such a massive consolidation.

- Market Concentration Concerns: Regulators may fear a combined FutureX would have outsized influence in too many industries.

- Vertical Integration Issues: Housing suppliers and distributors under one roof can risk anti-competitive foreclosure of rivals.

- Tying & Bundling: Antitrust watchdogs would heavily scrutinize any efforts to force customers to buy the full FutureX suite to access one part.

- Predatory Pricing: Even the appearance of FutureX using profits from one division to subsidize below-cost pricing in another could trigger complaints.

Examples:

-

- The FTC’s review of a FutureX merger could span months or years, assessing its potential impacts on competition across the auto, aerospace, social media, AI and transportation markets.

- Rivals like GM, Boeing, Meta may argue a combined Tesla-SpaceX-Twitter/X titan would have unchecked power to dominate multiple industries simultaneously.

- Forcing Twitter/X users or advertisers to use FutureX payment tools or requiring Tesla buyers to have Starlink as their car’s default internet could raise antitrust red flags.

- If Tesla-made batteries become ubiquitous across FutureX ventures, outside battery suppliers may complain their access to those companies is unfairly constrained.

- Using SpaceX’s NASA funding to let Tesla undercut rival electric car prices or Twitter/X to operate at a loss to gain market share would risk predatory pricing charges.

How to Proceed:

-

- Engage deeply with antitrust authorities early to understand their concerns and proactively craft solutions to ensure a FutureX merger promotes healthy competition.

- Structure the deal in stages (e.g. SpaceX + Tesla first, then others) to stagger the regulatory review and isolate competition issues in one vertical at a time.

- Commit to open interfaces, fair supplier/customer access, and no anti-competitive bundling to allay concerns about vertical integration and rival foreclosure.

- Devise robust internal controls to prevent commingling of funds or cross-division subsidies that could enable predatory pricing or other anticompetitive practices.

- Mount a compelling public interest case focused on how an integrated FutureX will accelerate innovation, expand output and produce consumer benefits in critical emerging industries.

Key Considerations:

-

- How might a merger affect competition in AI, a crucial focus area for FutureX? Musk would need to assuage fears of the combined entity boxing out AI rivals or hoarding talent.

- What markets would the DOJ/FTC see as most vulnerable to a post-merger FutureX? Electric/autonomous cars (Tesla + SpaceX), online ads (Twitter/X + Tesla), and aerospace/defense (SpaceX) stand out as probable antitrust lightning rods.

- Could FutureX still acquire promising startups without triggering antitrust concerns? Likely yes, but expect much deeper scrutiny of future deals, particularly in FutureX’s core verticals.

- How to weigh the consumer benefits of integration against the competition risks? Musk would need to show that combining his ventures expands access, improves quality, spurs innovation and/or lowers prices.

- What if regulators demand spinoffs to approve the merger? Having a plan to divest certain assets or business lines if needed for antitrust clearance would be prudent.

3. Navigate Securities Laws & Corporate Governance

-

- Merging Public & Private Entities: Combining Tesla (public) with SpaceX, et al (private) poses unique securities law challenges.

- Dual-Class Share Structures: Giving Musk super-voting shares to keep control may irk other shareholders and proxy advisors.

- Board Independence: Governance watchdogs would press for a majority-independent board to check Musk’s consolidated power.

- Related-Party Transactions: Musk would face intense scrutiny over any self-dealing between his ventures under the FutureX umbrella.

- Executive Compensation: Crafting CEO pay incentives that drive each division’s success without encouraging siloed thinking is tricky.

Examples:

-

- SEC rules around disclosures, financial reporting, and insider trading become immensely complex when combining public and private entities.

- Proxy advisory titans like ISS and Glass Lewis may recommend against the merger or board nominees if they see weak governance or misaligned incentives.

- Musk would be pressed to surround himself with independent directors who constructively challenge his instincts and act as a check on his power.

- Any contracts, asset transfers, loans or other dealings between Musk’s companies within FutureX would face investor scrutiny for potential conflicts of interest.

- Designing a CEO pay package that rewards Musk for the overall success of FutureX while still holding him accountable for each division’s standalone performance is a delicate balance.

How to Proceed:

-

- Assemble a world-class securities law firm and Big 4 auditor to meticulously navigate the financial reporting and compliance complexities of merging public and private companies.

- Structure the board with a supermajority of demonstrably independent directors with relevant industry backgrounds and no ties to Musk to provide effective oversight.

- Adopt governance guardrails like poison pills to prevent post-merger stake-building and protocols requiring independent director and/or shareholder approval of related-party transactions.

- Engage proactively with major shareholders and proxy advisors to articulate the governance protections and make the case for any dual-share class or other uncommon provisions.

- Craft Musk’s compensation as FutureX CEO to include both operational and market-based (stock price) metrics for each underlying venture to drive strong holistic performance.

Key Considerations:

-

- Will Musk still be able to tweet freely about FutureX and its divisions post-merger? He’d need robust social media protocols vetted by counsel to avoid selective disclosure or market manipulation concerns.

- How might the merger affect employee recruitment and retention? Equity grants would need to be thoughtfully rebalanced while preserving each division’s unique culture and incentive structures.

- What if FutureX’s board and Musk clash on strategy or capital allocation? A strong lead independent director, clear governance protocols, and the ability to overrule Musk if needed would be critical.

- Will creating a FutureX parent cause any of the subsidiaries to violate existing contracts or regulations? A thorough legal audit to identify any red flags up front would be wise.

- How to handle disclosures around related-party transactions within FutureX? Developing clear, consistent reporting standards that exceed legal minimums can boost investor confidence.

4. Assess the Tax & Financial Implications

-

- Optimal Transaction Structure: Whether a merger, acquisition or new holding company is most tax-efficient depends on myriad factors.

- Taxable vs. Tax-Free Deal: Structuring the transaction as a tax-free reorganization could avoid massive capital gains, but restricts future flexibility.

- International Tax Considerations: FutureX would need to carefully navigate the evolving web of cross-border tax rules and reporting requirements.

- Valuation & Exchange Ratios: Agreeing on the pre-merger value of each Musk venture and the appropriate share exchange ratios will be contentious.

- Post-Merger Financial Reporting: Creating consolidated financials, transfer pricing, and segment reporting for such diverse businesses is a huge lift.

Examples:

-

- FutureX might be structured as a tax inversion, moving the parent company’s domicile to a lower-tax jurisdiction to cut its effective global tax rate.

- A tax-free merger would let Musk and other shareholders defer capital gains taxes, but could limit FutureX’s ability to sell off various subsidiaries down the road.

- FutureX’s transfer pricing for shared technology, services or IP between its US and foreign entities will be heavily scrutinized by tax authorities worldwide.

- Investors in private ventures like SpaceX or Neuralink may balk if they feel their stakes are being undervalued or Tesla shareholders are getting an overly sweet deal.

- Post-merger, FutureX would need robust financial systems to track and report results on both a consolidated and individual entity basis to all stakeholders.

How to Proceed:

-

- Model out several potential transaction structures (taxable and tax-free) to find the optimal balance of tax efficiency, operational flexibility and regulatory simplicity.

- Bring together all ventures’ finance leads and external tax experts to map out a comprehensive global tax strategy that optimizes the combined entity’s worldwide footprint.

- Engage independent valuation firms to objectively assess each venture’s pre-merger fair value and recommend appropriate share exchange ratios for the deal.

- Begin aligning key accounting policies, procedures and systems pre-closing so the combined entity can produce consolidated financials seamlessly on day one post-merger.

- Develop detailed pro forma financials to help the FutureX management team and board make critical capital allocation and strategic decisions from the outset.

Key Considerations:

-

- How would a FutureX merger affect Musk’s access to capital? The scale and financial resources of the combined entity may open new fundraising options like a big bond offering.

- What revenue or cost synergies might exist across Musk’s ventures? Developing detailed projections of merger benefits is key to making the numbers work.

- How might key investors react to their ownership stakes being rolled into a new FutureX parent? Backchannel discussions to socialize the idea and solicit input can build early support.

- What happens to Tesla’s and SpaceX’s existing debt in a merger? Musk would need to engage with creditors to address any change of control or covenant issues.

- How would a merger affect Musk’s (and other top execs’) compensation and personal tax picture? Carefully analyzing the effects on management’s individual financial incentives is crucial.

Summary

Key Takeaway: Elon Musk consolidating his many ventures under one roof as “FutureX” is a fascinating idea fraught with major legal complexities across antitrust, securities, tax, governance and other legal domains. Elon Musk photo credit Justin Pacheco.

Chris Anderson’s suggestion that Elon Musk roll up all his companies into a single futuristic mega-corporation is undoubtedly thought-provoking. The potential synergies and world-changing innovations such an entity could unleash are tantalizing.

But as this guide illustrates, actually executing such an audacious corporate restructuring would require navigating a daunting gauntlet of legal and regulatory obstacles. From antitrust concerns to securities law complexities to tax and governance challenges, a FutureX merger would be a historic undertaking on par with the most complicated transactions in corporate history.

I’m not opposed to the idea in principle, but I’m not sure there is a pragmatic or legal way to merge them.

There is also value in equity incentives of people at the companies being tied to that company’s accomplishments.

— Elon Musk (@elonmusk) July 25, 2024

While the upsides of uniting Musk’s visionary ventures under one umbrella are intriguing, the potential legal risks and downsides can’t be ignored either. A deal of this unprecedented scope and scale happening anytime soon still seems unlikely.

But Musk has defied the odds and proved skeptics wrong before. Perhaps this wildly ambitious idea will light a spark for Musk and his teams to start probing what it would take to make FutureX a reality. After all, Musk’s ventures are fundamentally aimed at building the future. Uniting them to pursue that north star with singular focus is a captivating prospect.

Test Your FutureX Legal Savvy

Questions:

-

- 1. Which government agency would likely lead an antitrust review of a potential FutureX merger?

- A) Federal Trade Commission (FTC)

- B) Department of Justice (DOJ)

- C) Securities & Exchange Commission (SEC)

- D) Federal Aviation Administration (FAA)

- 2. What is a key corporate governance best practice for a combined FutureX board?

- A) Minority of independent directors

- B) Elon Musk holding both CEO and Chair roles

- C) Majority of independent directors

- D) No board needed, just Elon in charge

- 3. Structuring a FutureX merger as a “tax inversion” would likely involve:

- A) Relocating the parent company to the U.S.

- B) Relocating the parent company to a lower-tax foreign jurisdiction

- C) Relocating all operations to Mars

- D) No jurisdictional changes

- <strong4. Under securities laws, which Musk company’s shareholders would likely have the most leverage in a FutureX merger?

- A) SpaceX

- B) Tesla

- C) Twitter/X

- D) Neuralink

- 5. A top priority for the FutureX management team on day one after closing a merger would be:

- A) Issuing a press release

- B) Producing consolidated financial statements

- C) Announcing layoffs

- D) Launching a new marketing campaign

- 1. Which government agency would likely lead an antitrust review of a potential FutureX merger?

Answers:

-

- 1. A) The Federal Trade Commission (FTC) and Department of Justice (DOJ) would likely share antitrust oversight of a FutureX merger, but the FTC would probably take the lead given its focus on the tech sector. The SEC’s role is more about securities law compliance than antitrust.

- 2. C) Having a majority of demonstrably independent directors is a corporate governance best practice for any public company board, and would be especially critical for a combined FutureX to provide an effective check and balance on Musk’s control and conflicts of interest.

- 3. B) An “inversion” deal refers to relocating a company’s headquarters to a lower-tax jurisdiction, often outside the U.S. It’s a controversial strategy some multinationals have used to cut their tax bills, but one Musk might consider given FutureX’s global footprint.

- 4. B) As the only publicly traded company among Musk’s ventures today, Tesla’s shareholders would have the most legal clout in any merger. Securities laws give public company investors certain voting rights and anti-dilution protections that could be a counterweight to Musk’s control.

- 5. B) Producing consolidated financial statements would be an immediate priority for a newly combined FutureX to give investors and regulators a clear picture of the merged company’s financial position. Press releases and marketing can wait.

Disclaimer

The material in this article is provided for informational purposes only and does not constitute legal advice. The law is complex and changes frequently, and the information provided is not a substitute for consulting with a qualified attorney about your specific situation.

Reading this article does not create an attorney-client relationship, and you should not act or refrain from acting based on any information contained herein without seeking appropriate legal counsel. The author and publisher disclaim any liability in connection with the use of this information.

Any references to specific companies, individuals, or situations are purely hypothetical and for illustrative purposes only. Nothing in this article should be taken as an endorsement, criticism, or investment advice regarding any particular company, person, or course of action.

Also See

Classroom Confidential: Inside the Explosive Lawsuit Challenging California’s AB 1955