Starting an LLC in California can benefit your business, offering unique legal protections, tax advantages, and access to a vast network of resources and opportunities.

by LawInc Staff

November 20, 2023

With over 500,000 LLCs formed each year in California alone, limited liability companies remain a popular choice for many small business owners. Forming an LLC can help protect personal assets and reduce tax obligations.

However, properly establishing an LLC requires following strict legal formalities. Getting legal guidance from a business attorney is essential to ensure your LLC is set up correctly from the start.

Consult with a California Attorney Before Forming You Start an LLC

Taking shortcuts or seeking the least expensive LLC formation route can lead to challenges later on. It’s essential to understand the intricacies involved in setting up an LLC in California.

Detailed Navigation: From timing and formalities to understanding tax implications, every step in the LLC formation process requires meticulous attention.

Expert Guidance: LLC formation isn’t just about paperwork; it’s about laying a strong foundation for your business future. An attorney can provide the clarity and guidance needed to navigate this process effectively.

If you would like a licensed California attorney to help you start an LLC , simply complete our secure online order form to get the process started securely online or call us at (310) 765-2525.

Here are the top ten benefits of starting a California LLC:

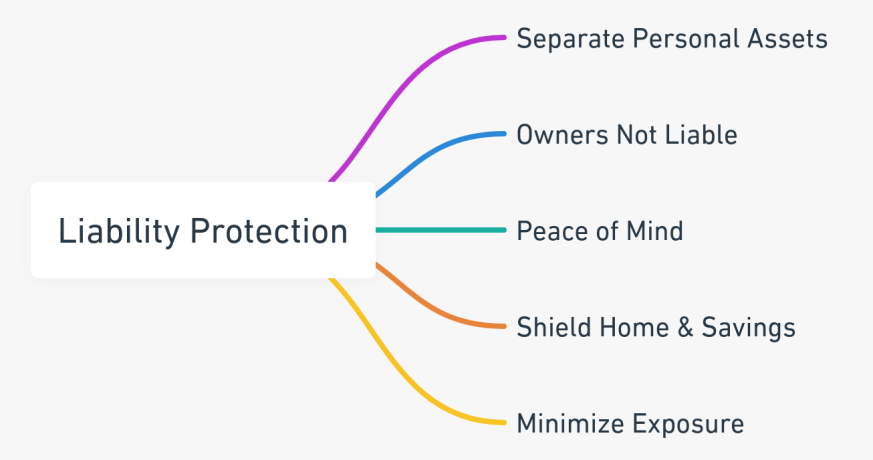

1. Liability Protection

Exploring the Liability Protection Benefits of Forming an LLC in California.

-

- Separate Personal Assets: LLC status separates personal and business assets; creditors can only seize LLC assets, not owners’ personal assets

- Owners Not Liable: LLC owners have limited liability; not personally responsible for LLC debts and legal claims beyond investment; liability is limited to their investment in the LLC

- Peace of Mind: Forming an LLC provides comfort, confidence; personal assets protected from the business; allows focusing on growing the business rather than worrying about risks

- Shield Home & Savings: Lawsuits cannot seize LLC owners’ homes, cars, investments, retirement accounts; these remain protected from business legal issues

- Minimize Exposure: LLC status minimizes owners’ financial exposure; limits risk of personal bankruptcy from business issues; business debts are not owners’ personal debts

-

- Formed LLC, separated personal/business assets.

- Personal assets like home, car protected from business liabilities.

- Focused on business growth without personal risk worries.

- LLC status brought peace of mind, security in business operations.

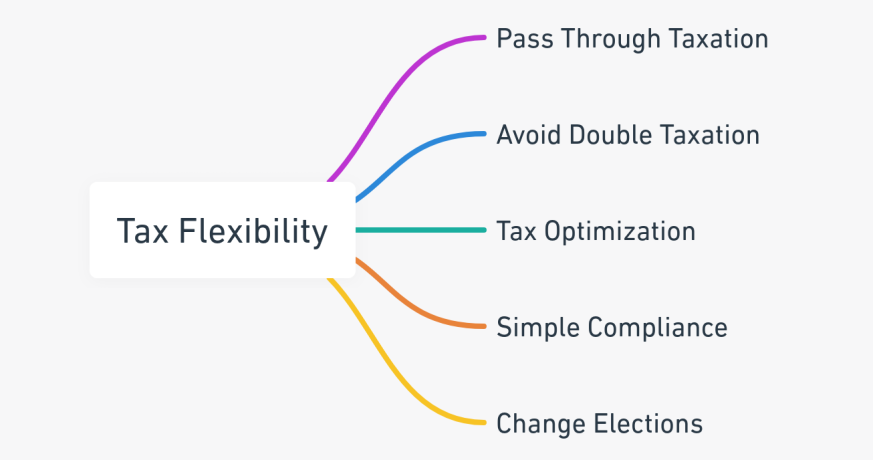

2. Tax Flexibility

Understanding the Tax Flexibility of LLCs in California.

-

- Pass Through Taxation: LLCs taxed as sole proprietorships (1 owner) or partnerships (2+ owners); pass profits directly to owners’ personal returns, avoiding corporate tax; avoids double taxation on dividends

- Avoid Double Taxation: LLC owners avoid corporate double taxation on dividends; profits taxed once personally through pass-through taxation

- Tax Optimization: LLC flexibility allows owners to optimize taxes; take deductions, write-offs, arrange income splitting; maximize tax advantages

- Simple Compliance: LLC tax compliance much simpler than corporate returns and filings; pass-through taxation easier than C-Corp taxation

- Change Elections: LLCs can change tax status each year; for example can elect to be taxed as an S Corporation; maximize flexibility as laws and needs change; provides options as business evolves

-

- Opted for LLC, gained pass-through taxation.

- Avoided double taxation on profits.

- Used tax flexibility for deductions, write-offs.

- Adjusted tax status yearly, optimizing for current needs.

- Simplified tax compliance, more focus on business growth.

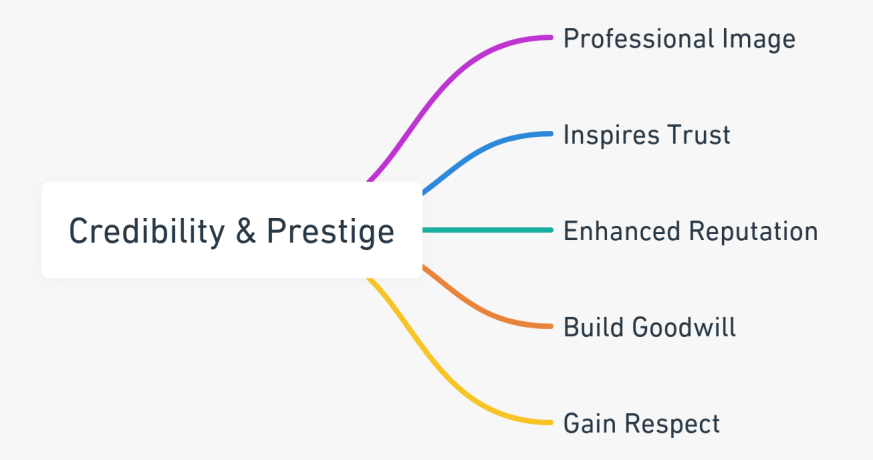

3. Credibility & Prestige

Enhancing Business Credibility and Prestige through an LLC in California.

-

- Professional Image: Being an LLC conveys legitimacy, formality; shows clients you are an official business entity; improves credibility

- Inspires Trust: Customers take LLCs more seriously, have more confidence than sole proprietors or DBAs; inspires consumer confidence

- Enhanced Reputation: LLC status implies established, higher quality company; gives competitive edge; implies greater prestige

- Build Goodwill: Operating as an LLC builds company identity, customer loyalty through memorable business name; creates brand recognition

- Gain Respect: Lenders, suppliers, partners respect LLCs more than sole proprietors; makes getting approved for loans/accounts easier; boosts credibility

-

- LLC formation enhanced professional legitimacy.

- Gained customer trust, confidence as an official business.

- Improved reputation led to competitive edge, more clients.

- Built brand identity, loyalty through LLC status.

- Easier loan approvals, higher respect from lenders, suppliers.

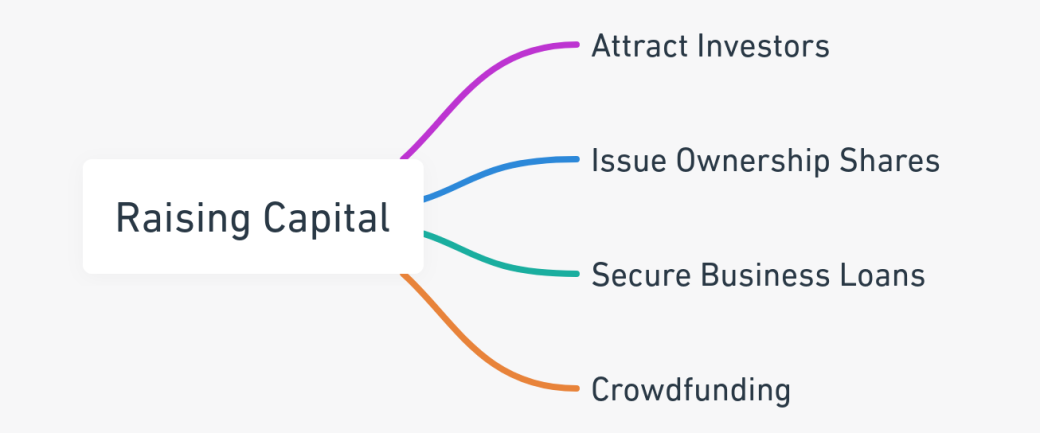

4. Raising Capital

Exploring Capital Raising Benefits for LLCs in California.

-

- Attract Investors: LLC structure attracts more investor attention, credibility than sole proprietorships or partnerships; establishes readiness for investment; gets more investor interest

- Issue Ownership Shares: LLCs can sell percentages of the company to raise investment funds; gives funding flexibility; attracts potential investors; enables soliciting needed capital

- Secure Business Loans: Forming an LLC improves the odds of getting approved for loans from banks; limited liability and formality help demonstrate credibility; shows bank the company is low-risk

- Crowdfunding: Crowdfunding campaigns can require having an official LLC structure to sell shares to numerous investors; enables broader capital raising; allows tapping into crowdsourcing

-

- LLC structure drew investor interest.

- Sold company shares to raise funds.

- Secured business loans easily, showing low risk.

- Used crowdfunding, leveraging LLC status for wider capital raise.

- Enhanced business credibility led to financial growth opportunities.

5. Transferable Ownership

Understanding the Flexibility of Transferable Ownership in California LLCs.

-

- Add or Remove Members: LLC membership flexible; can easily add or remove members per operating agreement; facilitates changes in ownership; adapts to evolving membership

- Divide Ownership: LLC ownership percentages can be divided, reallocated, transferred between members; enables reshuffling interests; divides control

- Transfer Shares: Members can transfer portions of their LLC ownership/shares without disruption; facilitates succession planning; enables smooth transitions

- Maintain Continuity: Transferring LLC ownership keeps operations smooth during membership shifts; provides ongoing stability; minimizes business disruptions

- Adapt to Changing Needs: LLC membership flexibility lets company adapt as business conditions change; respond to evolving needs; adjust ownership over time

-

- Easily added new members to LLC.

- Adjusted ownership percentages as needed.

- Smooth transfer of shares for succession planning.

- Maintained business stability during ownership shifts.

- Adapted to evolving business needs, ensuring continuity.

6. Continuous Existence

The Perpetuity of LLCs in California: Ensuring Business Longevity.

-

- Independent Existence: LLCs continue existing even after member departures, providing stability; ongoing beyond owners’ involvement

- Avoids Dissolution: Member changes do not dissolve an LLC like with sole proprietorships or partnerships; avoids business interruption

- Maintains Stability: LLC structure maintains continuity despite shifts in ownership; unaffected by member changes

- Outlives Founders: LLCs outlive original founders; does not depend on founders remaining involved; perpetual existence

- Business Succession Planning: LLC continuity makes ownership succession planning simpler; facilitates smooth transitions when founders leave; membership interests can be held under living trusts

-

- LLC remained stable despite member changes.

- Avoided dissolution from ownership shifts.

- Continuity maintained, business unaffected by member exits.

- Survived beyond original founders, enabling long-term planning.

- Facilitated smooth ownership transitions, preserving business legacy.

7. Flexible Management

Exploring the Flexibility in Management of California LLCs.

-

- Member-Managed: Allows equal participation in management by all members; democratic control

- Manager-Managed: LLCs can appoint designated managers to handle operations; concentrates control

- Customizable Structures: LLCs allow crafting customized management and decision structures; match processes to needs

- Divide Responsibilities: LLC flexibility allows clearly delineating management roles based on members’ strengths; play to strengths

- Adapt Over Time: LLCs allow fluid adjustments to management approaches as needs evolve; respond to changing conditions

-

- Chose member-managed structure for democratic control.

- Later shifted to manager-managed for focused leadership.

- Customized roles, responsibilities to members’ strengths.

- Adapted management as business evolved, needs changed.

- Ensured effective, responsive business operations over time.

8. Easy Compliance

Simplified Compliance for LLCs in California.

-

- Minimal Reporting: LLCs have lower reporting and compliance requirements compared to corporations; less stringent

- Lower State Fees: LLC formation fees and annual taxes are lower than corporations; saves money

- Few Ongoing Filings: After forming, few LLC changes require amended public filings; less paperwork

- Informal Record-Keeping: LLC record-keeping, documentation much simpler than corporations; fewer requirements

- No Ownership Limits: Unlike S-Corps, no limits on number/type of LLC members; greater flexibility

-

- Enjoyed minimal reporting requirements.

- Benefited from lower state fees, tax savings.

- Fewer ongoing filings, reduced paperwork burden.

- Simplified record-keeping, easier to manage than corporations.

- No limits on member types, added flexibility.

9. Privacy & Anonymity

Ensuring Privacy and Anonymity for LLC Owners in California.

-

- Avoid Public Records: LLC membership details not accessible through public listings; names stay private; if opt for a manager-managed LLC

- Maintain Confidentiality: LLC status allows owners to keep their identity, involvement confidential; secrecy maintained; via a manager-managed LLC

- Remain Anonymous: LLCs can use registered agents to help preserve owners’ anonymity; if intermediaries used

-

- Chose manager-managed LLC for anonymity.

- Kept ownership details private, not in public records.

- Used registered agent to help maintain confidentiality.

- Enhanced privacy, shielded personal involvement in business.

10. Deductible Expenses

Maximizing Tax Benefits through Deductible Expenses in California LLCs.

-

- Write Off Expenses: LLC owners can deduct operating expenses, equipment purchases, rent, supplies; reduces tax burden

- Deduct Benefit Costs: Any health insurance, benefits provided to employees are deductible; lowers taxable profit

- Deduct Travel and Meals: Business trips, meals, entertainment with clients can be written off; taxable income reduced

- Deduct Equipment: Assets like computers, furniture, vehicles help reduce LLC’s taxable income; depreciation

- Deduct Professional Fees: Expenses like legal advice, consulting, and accounting are deductible; cuts tax burden

-

- Deducted operating expenses, equipment costs.

- Wrote off health insurance, employee benefits.

- Claimed deductions for business travel, meals.

- Reduced taxable income with asset depreciation.

- Expensed professional fees for legal, accounting services.

Start your LLC now via our secure online order form to get the process started securely online or call us at (310) 765-2525.

Also See:

7 California LLC Formation Advantages