Tax

RECENT ARTICLES

LLC: The Estate Planning Tool

January 01, 2019 04:01 pm by LawInc Staff

Estate planning is an important tool to ensure your family’s financial safety and security, once you have passed. Although a...

Holiday Office Party Deductions: 4 Rules, 100% Deduction

December 20, 2017 10:12 am by LawInc Staff

With the holidays fast approaching, employers are eager to throw their annual office holiday parties. Business holiday parties are a...

Holiday Business Expenses - What is Tax Deductible?

November 27, 2017 08:11 am by LawInc Staff

With the holidays approaching, it is important for business owners to consider what expenses are and are not tax deductible....

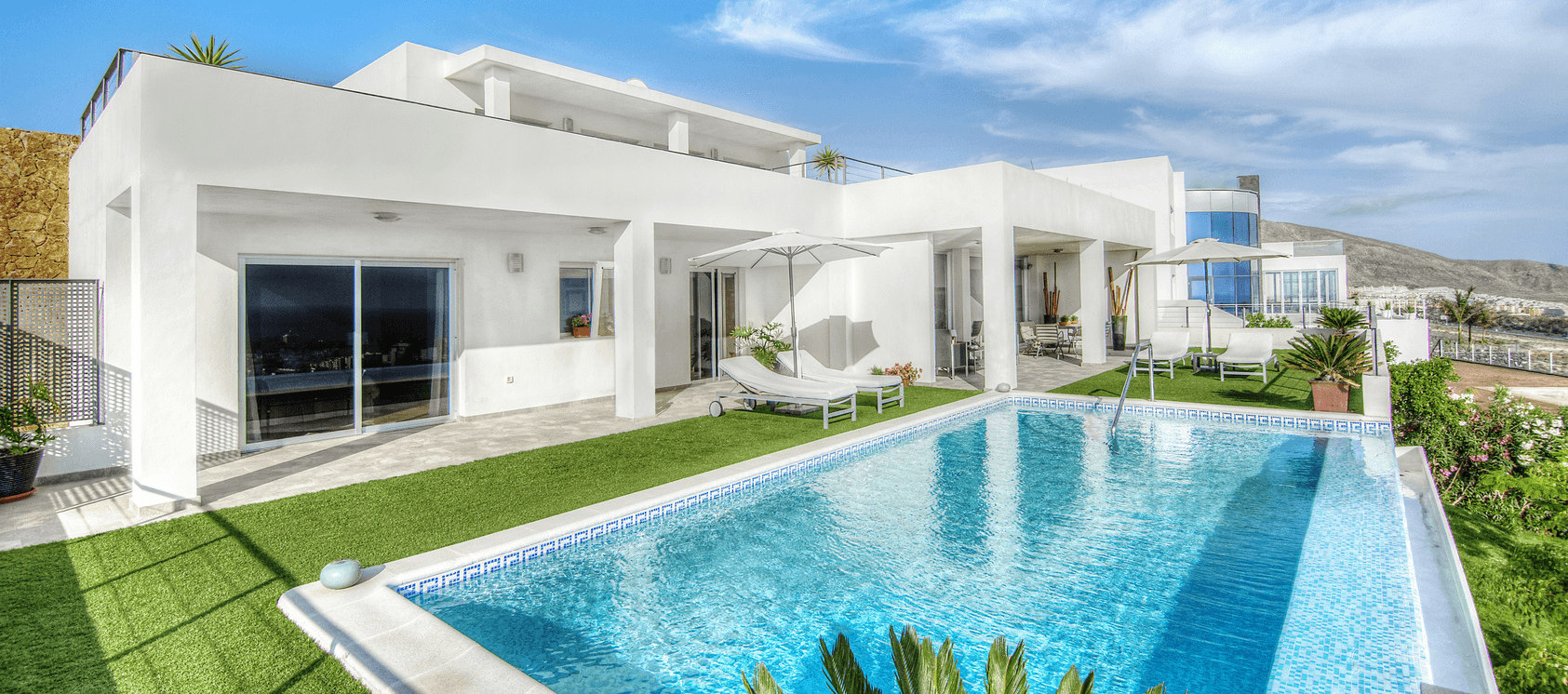

IRS 1031 Exchanges: How to Save Money on Your Real Estate Investments

December 20, 2015 04:12 pm by Maria Kozak

If you make a gain from a sale, you generally have to pay a tax on the gain. If you...

Robin Williams' Trust Bans Use of His Image for 25 Years

March 31, 2015 05:03 pm by Sheren Javdan

The Robin Williams Trust, filed Wednesday as an exhibit in connection with the division of his personal property, reveals that the late...

Benefits of a 401(k) For Your Business

March 20, 2015 02:03 pm by Sheren Javdan

Have you considered a 401(k) for your business? A 401(k) is a retirement plan that business owners can opt to...

Independent Contractor vs. Employee

May 01, 2014 05:05 pm by Sheren Javdan

Individuals hired by business owners to work their business can either be classified as an independent contractor or employee. Sometimes...