by Sheren Javdan

July 28, 2014

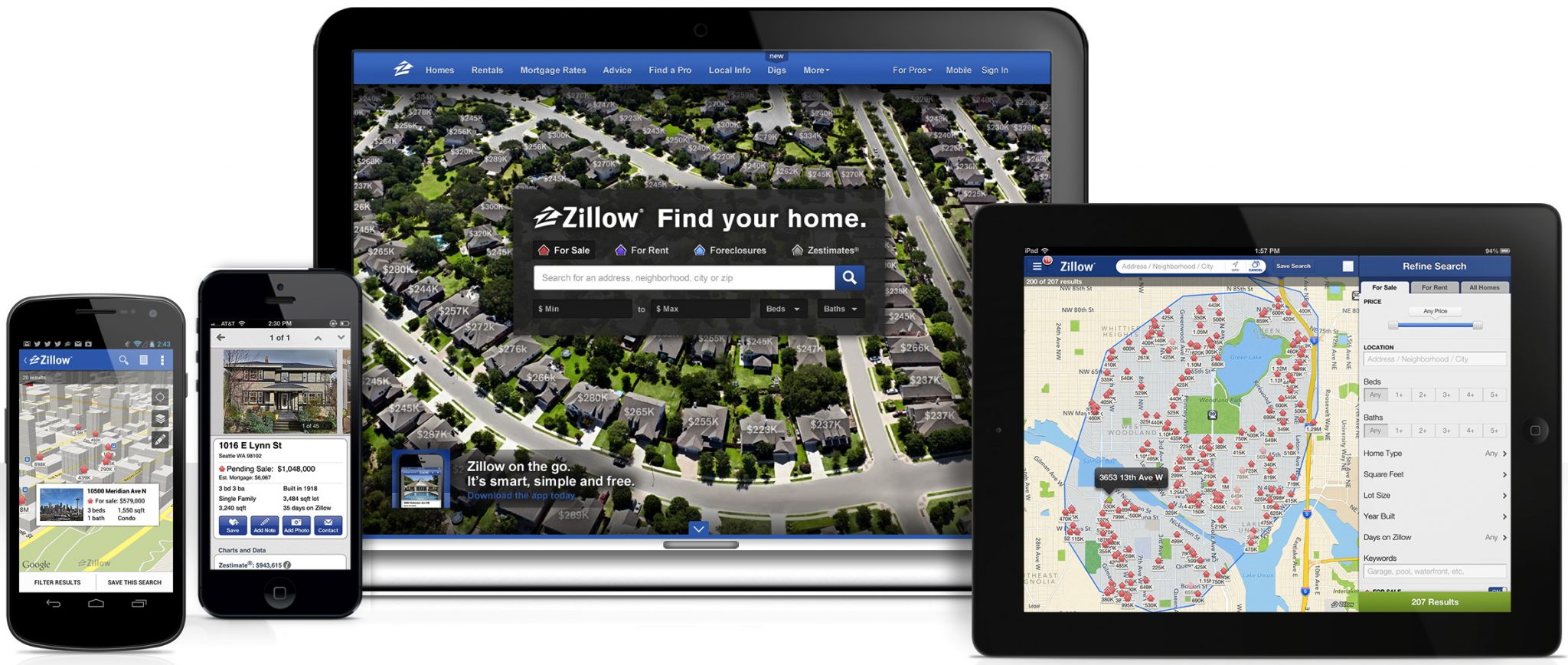

The two most visited online real estate websites have joined forces to create the largest online real estate market. Zillow is purchasing Trulia, its well known nemesis, for a whopping $3.5 billion in stock. Washington corporation, Zillow, Inc., and Delaware corporation Trulia, Inc., offer online platforms where members can use tools to search for all the information they need to be successful in their real estate purchasing process.

Currently, each company generates the majority of their revenue through advertisement slots. However, there is plenty of room to grow revenue as less than 4% of approximately 12 billion real estate professionals spend money on marketing and advertising each year. By joining forces, the companies will reach out to a larger real estate audience and generate a greater revenue through marketing and advertising. The two websites are growing at a rapid speed on both the web and mobile applications and this will allow advertisers to reach a larger audience.

Last month, Zillow set a record and reported over 82 million users while Trulia reported over 53 million users across their websites and mobile applications. Furthermore, both companies have “limited consumer overlap” where half of Trulia’s users do not visit ZIllow and two thirds of Zillow’s users do not use Trulia.

As a result, The merger will still allow each company to maintain their consumer brands, offer buyers, sellers and renters free access to real estate information and enable professionals to grow their businesses through advertisements. By maintaining two separate brands, the company will continue to target different crowds, offer different products and distribute their services through different mediums.

TERMS OF THE DEAL

The deal, expected to close in 2015, was approved by both companies’ boards and each CEO will resume their positions at the company. Pete Flint, CEO of Trulia will report to Zillow CEO Spencer Rascoff. In addition, a second member of Trulia’s board will join the combined board members.

According to a statement released by Zillow, under the merger, Zillow has entered into an agreement to acquire Trulia for $3.5 billion in a stock-for-stock transaction. Trulia shareholders will receive 0.444 shares of Zillow’s common stock for each share of Trulia stock. The 0.444 translates to approximately 33% of the combined company stock.

Zillow common stock holders will receive a comparable share of the combined company stock, translating to approximately 67% of the combined company stock. The deal is set to close at a 25% premium on the company’s closing price of $56.35 on July 25, valuing each share at $70.53.

EXPECTED COMPANY BENEFITS

Among other things, Zillow and Trulia expect to speed up the website and mobile application innovation wheel and provide users with more valuable tools and services that can help make their real estate experience more seamless.

In addition, the two plan on providing users and real estate professionals with more information about the real estate market, housing trends and forecasts that can allow them to make informed decisions when purchasing or choosing to not purchase a property.

By joining forces, the two will distribute listings across more platforms which can help enhance both marketing and users at a larger scale. By receiving more attention for fewer advertisements, real estate professionals will gain a greater return on their investments.

“Consumers love using Zillow and Trulia to find vital information about homes and connect with the best local real estate professionals … This is a tremendous opportunity to combine our resources and achieve even more impressive information that will benefit consumers and the real estate industry” Rascoff said.